Issue:November/December 2016

NSCLC MARKET - Global Drug Forecast & Market Analysis to 2025

INTRODUCTION

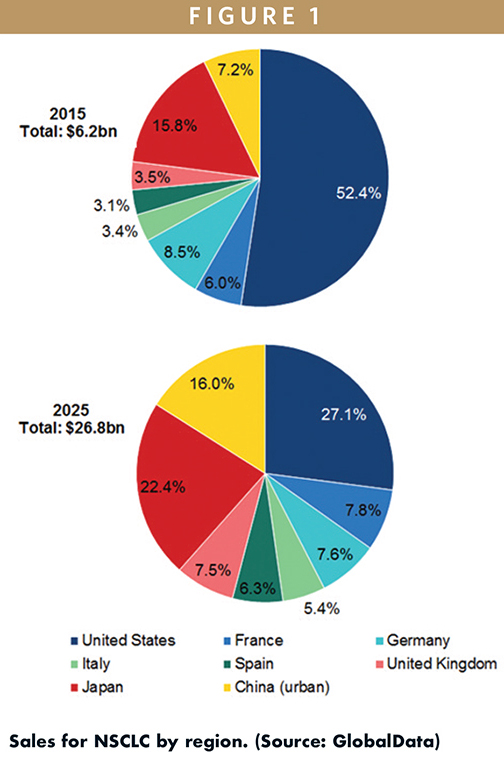

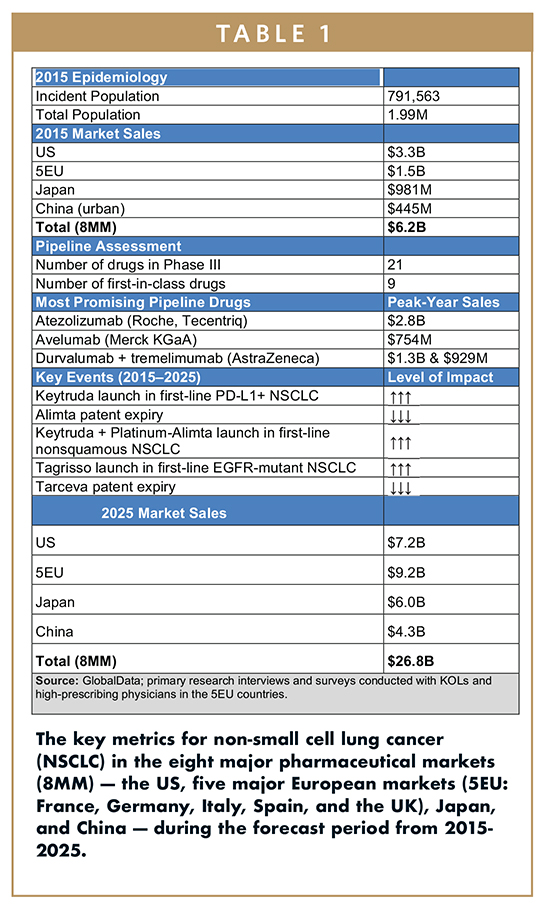

GlobalData estimates that the value of the Non-Small Cell Lung Cancer (NSCLC) market in the 8 major markets (8MM) in 2015 was $6.21B. This market is defined as sales of major branded drugs commonly prescribed for NSCLC patients across the 8MM. Just over half of these sales, $3.25B (52%), were generated in the US, with the 5EU representing the next largest region by sales, estimated at $1.53B (25%). Japan and China contributed the smallest proportions of sales to the global NSCLC market, with 2015 sales of $981M (16%) and $445M (7%), respectively.

By the end of the forecast period in 2025, GlobalData projects NSCLC sales to rise to $26.8B in the 8MM, at a moderate Compound Annual Growth Rate (CAGR) of 15.7%. In particular, GlobalData expects the China NSCLC market to grow most rapidly, increasing to $4.3B (16% of global NSCLC shares) by 2025 at a robust CAGR of 25.4%. Sales in the other regions are also expected to increase by the end of the forecast period; however, the proportion of sales from the US and Japan are forecast to decrease to 26.9% and 22.3%, respectively, with market share in the 5EU increasing from 24.2% in 2015 to 34.3% by 2025.

MAJOR DRIVERS OF GROWTH

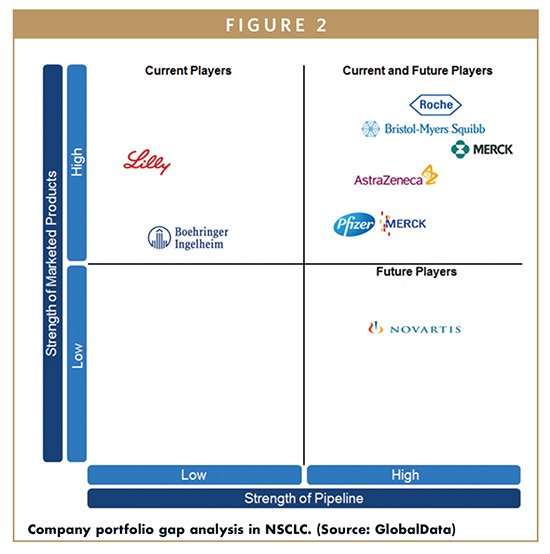

The increasing incorporation of premium-priced immune checkpoint inhibitor immunotherapies into the NSCLC treatment algorithm, particularly in the first-line setting, will be one major driver. Merck & Co.’s Keytruda (pembrolizumab), Bristol-Myers Squibb’s (BMS’) Opdivo (nivolumab), and Roche’s Tecentriq (atezolizumab), will all achieve blockbuster status by the end of the forecast period. Collectively, immunotherapies will reach $17.5B in sales by 2025, accounting for roughly 65% of total sales in the NSCLC market. Of the $17.5B total, Keytruda, Opdivo, and Tecentriq are projected to contribute $5.2B, $5.5B, and $2.8B, respectively.

Targeted therapies are also expected to contribute to the growth of the NSCLC market. Overall, targeted therapies will have sales of $9.4B by 2025, with AstraZeneca’s Tagrisso (os- imertinib) and Roche’s Avastin (bevacizumab) having the highest sales of this drug class, followed by Eli Lilly’s Cyramza (ramucirumab). Tagrisso is projected to achieve blockbuster status by 2025, with $1.7B in estimated sales, reflecting a CAGR of 56.6% over the forecast period. Its sales will be driven by its uptake in the second line and, eventually, in the first-line setting in EGFR-mutant patients. Avastin sales are expected to grow modestly from $1.3B in 2015 to $1.6B by 2025 at a CAGR of 1.9%, fueled by increased uptake in nonsquamous patients, but stunted by biosimilar erosion that will occur in the 8MM over the forecast period, starting in 2018. In fact, Avastin’s market share is sufficiently large that biosimilar bevacizumab is expected to achieve $1B in sales by 2025, assuming it will be priced at a 30% discount compared to branded Avastin. Cyramza sales are expected to grow from $84M in 2015 to $613M in 2025 at a CAGR of 22%, driven by launches in Japan and China.

The increasing incidence of NSCLC in the 8MM will also drive growth. China, in particular, will see its NSCLC incident cases increase significantly over the forecast period, at an Annual Growth Rate (AGR) of 4.7%. Overall, across the 8MM, the incidence of NSCLC is expected to increase at an AGR of 3.1% from 2015-2025. Growth in incidence is forecast to be most pronounced in urban China, where GlobalData expects there to be approximately 500,000 in 2025, rising from just over 330,000 cases in 2015 at an AGR of 4.7%. This increase, coupled with an anticipated increase in branded therapy prescriptions in China, will drive the growth of both the Chinese and global NSCLC markets over the forecast period.

MAJOR BARRIERS OF GROWTH

Patent expiration of several blockbuster drugs, including Tarceva and Alimta, will limit growth. Tarceva, the leading epidermal growth factor receptor-tyrosine kinase inhibitor (EGFR-TKI) in the NSCLC market, is expected to face patent expiry starting in 2016. GlobalData expects sales of the patented drug in the 8MM to decrease from $783M in 2015 to $18M by 2025. Meanwhile, sales of generic erlotinib are expected to reach $77M by 2025. In addition, sales of Alimta, which is commonly used in combination with chemotherapy in nonsquamous patients, will decrease from $2.1B in 2015 to $54M in 2025. Sales of generic pemetrexed are expected to reach $266M by 2025. GlobalData anticipates the uptake of generics to negatively impact the growth of the NSCLC market throughout the forecast period.

Pricing and reimbursement difficulties encountered by premium-priced drugs, especially in the European and Asian markets, are another major barrier. Increasing cost-consciousness will limit premium pricing opportunities for pipeline agents in the NSCLC market. Healthcare austerity measures are being incorporated across the major markets, and drug companies will need to consider the changing reimbursement landscape when determining pricing strategies for their drugs. GlobalData expects that this era of austerity and healthcare reform will negatively affect pharmaceutical companies’ ability to gain reimbursement approval for their new NSCLC therapies, particularly immuno-oncology (IO) combinations that are extremely expensive.

COMBINATION THERAPY IS THE MAIN STRATEGY

In 2015, the NSCLC market was largely dominated by generic chemotherapy and targeted therapies, including EGFR and anaplastic lymphoma kinase (ALK)-TKIs, accounting for approximately 94% of the NSCLC market, while IO sales accounted for just 6%. In 2025, that trend will be reversed, with 65% of the total NSCLC market going to IO therapies, and the remaining 35% being split between chemotherapy and targeted agents.

A major trend in corporate strategy is the pairing of programmed cell death protein 1 (PD-1) checkpoint inhibitors with other agents. In the crowded PD-1 space, as drugs with identical mechanisms of action (MOAs) are launched, companies are looking for ways to boost efficacy in hopes of differentiating their product from that of their competitors. As such, companies like Merck & Co., Roche, and BMS are evaluating their PD-1 checkpoint inhibitors in combination with chemotherapies, targeted agents, and/or other IO products. BMS has high hopes for the combination of Opdivo + Yervoy (ipilimumab) in firstline therapy, while Merck & Co. and Roche have focused on evaluating IO + chemotherapy combinations. Roche is also investigating the combination of its programmed death ligand 1 (PD-L1) inhibitor Tecentriq + chemotherapy + Avastin in chemotherapy-naïve nonsquamous NSCLC patients in the ongoing Phase III IMpower 150 trial.

Currently, BMS is the market leader in the second-line setting, with Merck & Co. coming in second due to the inconvenience of Keytruda’s label restriction hampering its uptake. This ranking is not expected to change during the forecast period, as Opdivo has a stronghold in the second-line setting. However, in the first-line setting, due to Keytruda’s anticipated first-to-market advantage as a monotherapy in PD-L1+ patients following Opdivo’s Phase III failure, GlobalData expects Merck & Co. to become the market leader over the forecast period. Roche also has a strong pipeline strategy, evaluating combinations of Tecentriq with chemotherapies and/or targeted therapies in multiple Phase III trials that all have the potential to lead to approval.

A FOCUS ON IMPROVING TARGETED THERAPY OPTIONS

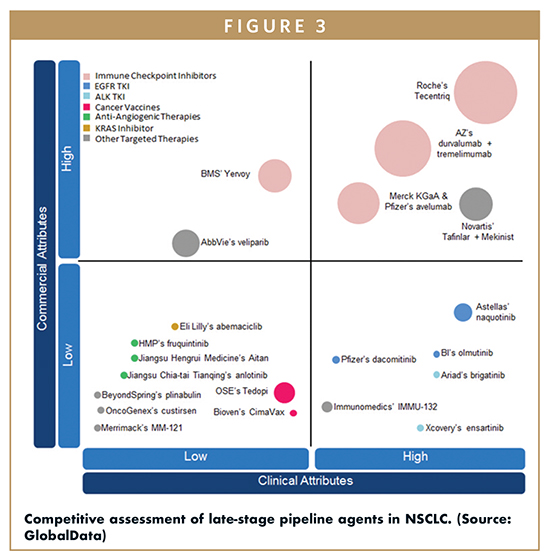

In the targeted therapy arena, companies are developing novel therapies for previously unactionable mutations. KRAS mutants are an example of a patient subpopulation that makes up a significant (25% to 30%) share of the total NSCLC patient pool, but for which there are no targeted therapies currently available. Eli Lilly & Co.’s pipeline agent abemaciclib targets KRAS patients, yet its lack of efficacy is expected to severely limit its uptake, leaving opportunities for other KRAS targeted therapies to enter the space. Recently, AstraZeneca’s selumetinib, another KRAS targeted therapy, failed its Phase III trial, leaving the KRAS mutant population without any effective late-stage pipeline drugs. In addition to KRAS, BRAFV600E is also being explored as a target. This mutation has already been successfully targeted in melanoma by the combination of Novartis’ Tafinlar (dabrafenib) + Mekinist (trametinib), which is expected to make a big impact for this patient population. However, the size of the eligible patient pool will limit its sales to $318M for Tafinlar and $278M for Mekinist by 2025.

In addition to novel therapies, companies are also developing second- and third-generation targeted therapies to provide better options for patients with actionable mutations. These newer targeted therapies commonly overcome resistance from first-generation treatments, and/or have superior efficacy in certain subpopulations. For example, AstraZeneca’s Tagrisso is effective in Tarceva/Iressa (erlotinib/gefitinib)-resistant EGFR mutation positive (EGFRm+) patients, while Roche’s Alecensa (alectinib) and Novartis’ Zykadia (ceritinib) have both been reported to be effective in ALK mutation positive (ALKm+) patients with brain metastases. GlobalData expects these next-generation targeted therapies to take significant patient share away from their predecessors. Tagrisso is expected to achieve sales of $1.7B by 2025, while Alecensa and Zykadia are expected to achieve sales of $600M and $127M, respectively. All three drugs will have high CAGRs, with Tagrisso being the highest, at 56.6%, followed by Alecensa at 24.5%, and Zykadia at 13.3%. The sales of EGFRTKIs as a class will grow at a CAGR of 4.9%, while the ALK-TKI sales will grow at a CAGR of 10.7%. Targeted therapies other than EGFR- and ALK-TKIs are also expected to see significant sales growth, from $1.5B in 2015 to $5.3B by 2025.

UNMET NEED IN THE NSCLC MARKET EXPECTED TO DECLINE

One of the main unmet needs in NSCLC treatment is the need for more effective first-line treatment options that provide overall survival (OS) benefits to patients with no actionable mutations. Currently, the standard-of-care in the first line is platinum-doublet chemotherapy, which has significant systemic toxicity and low compliance rates. During the forecast period, PD-1 checkpoint inhibitors are expected to launch in the first-line setting both as monotherapies and in combination with chemotherapy or CTLA4 checkpoint inhibitors. With the entry of these IO products, first-line treatment algorithms are expected to change, with IO drugs expected to take a majority of patient share away from standard chemotherapies.

REMAINING UNMET NEED IS HIGHEST WHERE?

Although the current and future IO drugs will significantly reduce unmet needs in NSCLC, there remains high unmet need in the PD-L1-negative patient population. This population of patients has been shown to receive minimal benefit from PD-1 agents thus far. There has been some evidence that the combinations of IO + IO or IO + chemotherapy, such as Opdivo + Yervoy and Keytruda + chemotherapy, respectively, may enhance response rates in this patient pool, but the data are preliminary and need to be confirmed in larger patient populations in ongoing clinical trials.

OPPORTUNITY REMAINS

An opportunity remains for drugs that target novel biomarkers/mutations in NSCLC. KRAS mutants, which account for a significant portion (25% to 30%) of the total NSCLC patient population, are the most underserved patient segment, with no currently available targeted drugs. Further, there are also rare mutations that lack targeted therapies. For example, NSCLC patients with the BRAFV600E mutation, which has already been successfully targeted in melanoma, have no available targeted therapies at this stage. During the forecast period, the unmet need for drugs targeting novel biomarkers/mutations will decline with the entry of the first-in-class, KRAS-targeting pipeline drug, Eli Lilly’s abemaciclib. For BRAFV600E-mutant NSCLC, Novartis’ combination therapy of Tafinlar + Mekinist, which is already approved to treat BRAFV600E+ melanoma, is expected to become available.

Despite the launch of drugs addressing the unmet need in KRAS and BRAFV600E patients during the forecast period, there remains opportunity for further development of targeted therapies, particularly in squamous NSCLC. Since the mutations found in squamous NSCLC are almost entirely distinct from well-described mutations, such as EGFR and ALK that occur in nonsquamous disease, there is ample opportunity for companies to develop targeted therapies against mutations associated with squamous NSCLC. Some of these include PIK3CA amplification/mutation, FGFR1, PTEN, and DDR2.

IMMUNO-ONCOLOGY DRUGS: RAPID UPTAKE

Roche’s Tecentriq is expected to launch in combination with chemotherapy and/or Avastin in the first-line setting for NSCLC. It is a “me-too” drug that will compete with marketed products Opdivo and Keytruda, both of which are already approved in the second line and are seeking label expansions into the first line. Projected peak-year sales for Tecentriq are $2.8B. The majority of these sales will come from the first line, but a small portion will also come from the second-line setting once Tecentriq gains approval.

AstraZeneca’s combination of durvalumab + tremelimumab is expected to launch in the first- and third-line settings in NSCLC. This combination is one of two that pair a PD-1 inhibitor with a CTLA4 inhibitor — the other being Opdivo + Yervoy. Projected peak-year sales for durvalumab and tremelimumab are $1.7B and $1.1B, respectively. Durvalumab + tremelimumab combination therapy is expected to lag behind monotherapy and IO + chemotherapy combinations in uptake due to its high cost.

WHAT DO THE PHYSICIANS BELIEVE?

IO drugs are generating excitement within the NSCLC community, as they provide a much-needed alternative to chemotherapy in the second-line setting, especially for squamous NSCLC patients. However, despite the enthusiasm for, and expected rapid uptake of, IO drugs during the forecast period, some KOLs have mixed views on PD-1 checkpoint inhibitor use in NSCLC. They view the low response rates seen with PD- 1/PD-L1 inhibitor therapy and the high costs of these drugs as negatives, and speculate that their widespread use in all patients would be financially impractical. GlobalData expects that these concerns will need to be addressed in the form of combination therapies that increase response rates and potentially elicit responses in PD-L1-negative patients; with regard to cost, concerns can be addressed through pricing negotiations between companies and national healthcare agencies in order to support the widespread use of IO drugs in NSCLC. Alternatively, IO drugs may eventually be restricted to patients with the highest expression levels of tumor PD-L1 as a way for payers and nationalized healthcare systems to control costs in the long run.

To view this issue and all back issues online, please visit www.drug-dev.com.

Dr. Cai Xuan is an Oncology Analyst at GlobalData in Boston. She provides in-depth scientific analysis of products within the oncology pharmaceutical sector and constructs market forecast models based on business intelligence. She has authored several expert insights that delve into market analysis of innovative treatment strategies in oncology. She earned her BS and PhD in Microbiology, Immunology, and Molecular Genetics, from the University of California, Los Angeles (UCLA). Prior to joining GlobalData, she was a post-doctoral fellow at the John Wayne Cancer Institute in Santa Monica, California.

Dr. Volkan Gunduz is an Oncology Analyst at GlobalData in Boston. He offers in-depth market intelligence and data interpretation within the oncology pharmaceuticals sector. He earned his PhD in Genetics at Tufts University, where he studied the role of Retinoblastoma tumor suppressor protein in bone development and cancer. He earned his BSc in Molecular Biology and Genetics at Bilkent University, Turkey. Previous to joining GlobalData, he worked at Children’s Hospital Boston and New York University as a post-doctoral fellow working on projects that investigated the impact of dietary restriction on lung tumorigenesis and the gene network that regulates muscle stem cell identity.

Total Page Views: 32518