Issue:April 2022

SPECIAL FEATURE - Excipients: Exciting Expansion & Innovation

The global pharmaceutical excipients market was valued at $7.7 billion in 2020 and is expected to reach $11.2 billion by 2026. Functional excipients are witnessing a strong demand as companies supply a wide range of functional excipients that help manufacturers produce cost-effective, high-quality, finished pharmaceutical product.1 Many industry experts point to a widening demand and use of organic pharmaceutical excipients. These organic excipients include oleochemicals, petrochemicals, proteins, carbohydrates, and others. Additionally, binders and functional excipients are witnessing a strong demand. Regarding delivery route, it is the topical segment that is witnessing fast growth in the global pharmaceutical excipients market, as topical drug delivery is witnessing a significantly stronger progression because of its ability to surpass the metabolism pathways of the stomach and liver.2

However, the high cost associated with the drug development process will impede the growth rate of the pharmaceutical excipients market. Additionally, strict government regulations have hindered the pharmaceutical excipients market growth. Safety, quality concerns, and lack of awareness will further challenge the market in the forecast period mentioned above.3

This is particularly true for novel excipients, which do have technical, therapeutic, and commercial benefits in oral drug delivery. Despite their formulation-enhancing benefits, novel excipients are sacrificed early in development because of a lack of precedence of use.

“Without an independent pathway to allow new excipients or new uses for existing excipients into drug products, except when associated with a drug filing, there are limited tools available for pharmaceutical companies to formulate better performing, and in many cases, life-saving drugs,” says Shaukat Ali, PhD, Technical Service Manager, BASF. “Meanwhile, drug manufacturers are reluctant to use new excipients and take on the additional layer of scrutiny from regulatory agencies to demonstrate full excipient characterization, safety, quality, function, and appropriateness of use.”

The Food & Drug Administration (FDA) has acknowledged that the lack of novel excipients is indeed a problem. In September 2021, the Agency announced the Novel Excipient Review Pilot Program, which will select and review four novel excipients in the next two years using a new pathway. This will allow manufacturers to obtain an FDA review prior to the use of the novel excipient in a drug formulation.

“FDA’s recent stance and acceptance that the novel excipients are critical in development of new drug candidates, the perceptions around the novel excipients are being changed as the Agency continues to embrace the facts that the pharma industry is in dire need of new excipients for bringing the innovative drugs to the market faster,” says Dr. Ali. “This is the first time in history that the agency is opening doors for novel excipients to be freely evaluated and used in the innovative formulations for NCEs.”

“Note, though, that this is not an excipient approval process; the novel excipient would still be evaluated as part of the overall drug product approval,” says Dr. Iain Moore, Head of Global Quality Assurance, Croda International. “In the next three to five years, we can expect to see an acceleration in the examination of the composition and purity of excipients.”

In this exclusive annual report, Drug Development & Delivery presents a unique look at how excipients are being used to support today’s and future innovative active pharmaceutical ingredients.

Aceto: Custom Raw Material Development

Novel excipients, compressed excipients, and modified excipients are growing in demand globally. The industry as a whole is evolving at a rapid pace to different methods for dosage and delivery — such as targeted immunotherapies that require unique solutions that in many cases cannot be provided by IID-listed excipients. For parenteral delivery, there is a need for excipients that can improve solubility and chemical and physical stability. The need for novel excipients is increasing as well as current excipients listed in the IID, but those intended to be used for a new route of administration, at a higher dosage level, or modified in some way is ever increasing.

Novel excipients are increasing, but with longer development time lines, higher cost, and higher risk of regulatory rejection. “We at Aceto have witnessed a higher demand for modified excipients with low impurity profiles required for parental and biopharmaceutical applications,” says Gearoid O’Rourke, Vice President of Global Marketing at Aceto.

He adds that well-known excipients with established quality standards can be modified with regard to their impurity profile or their physical properties. High purity grades of excipients that have a reduced level of reactive impurities are desired to increase the stability of sensitive active ingredients.

“Examples of these modified excipients and critical raw materials manufactured at Aceto’s North American GMP facilities would be PMSF, Phenol red and, most recently, our new low endotoxin Sucrose with endotoxin levels <2EU/g,” says Mr. O’Rourke. “Aceto understands the growing demand for novel or custom/modified excipients and offers custom raw material/excipient development through a practical process approach at one of our R&D centers of excellence around the world, with all manufacturing performed at our North American, European, or Indian GMP facilities.”

BASF: Opening the Door to New NCEs

BASF has launched several excipients due, in part, to many new chemical entities (NCEs) being either poorly soluble and less bioavailable; highly bitter, requiring taste masking, particularly in pediatric formulations; or highly incompressible in direct compaction with individual physical blends of excipients. To address these issues, BASF has introduced several excipients:

• Kollicoat® Smartseal 30 D (dispersion), or its powder form Kollicoat Smartseal 100P, is comprised of methyl methacrylate and diethylamino ethyl methacrylate (7:3), is a taste-masking polymer for bitter drugs, and is used as a moisture barrier for sensitive APIs. Its lipophilic nature prevents the degradation of highly sensitive drugs.

“For formulators interested in identifying the polymers with multiple functionalities, such as taste masking and moisture barrier coating, Kollicoat Smartseal opens the door to many new NCEs,” says Shaukat Ali, PhD, Technical Service Manager, BASF.

- Kollitab® DC 87 L is a lactose-based, co-processed excipient for direct compression of APIs, also amenable to continuous manufacturing processes. It is compatible with acidic or basic APIs, and is highly compressible with increased drug loading for tableting and compatible to stability.

- Soluplus® is a polymeric solubilizer (HLB 16) comprised of grafted polycaprolactam and polyvinyl acetate on a polyethylene glycol chain. It is widely used for increasing solubility and enhancing bioavailability. It has been marketed globally in several drugs and several others are in clinical development.

“The reasons for introducing these excipients are multifold,” says Dr. Ali. “In the recent past, over 80% of the NCEs are poorly soluble and bioavailable. Thus, developing those molecules as drug candidates remains challenging, and requires the innovative, novel excipients to expedite the development process for improving solubility and permeability of these molecules as well as compatibility to formulation technologies, especially processing at higher temperatures and conditions.”

As an example, Soluplus possesses a lower glass transition temperature (Tg) 72°C, making it suited for hot melt extrusion at 130°C or higher temperatures without plasticizers for high melting crystallized drugs and converting them into amorphous solid dispersions (ASD) to help improve the solubility and bioavailability. Soluplus is also a polymeric solubilizer with HLB values of 14, is used in development of several ophthalmic and topical formulations, making it just one of BASF’s multifunctional excipients.

“Multifunctional means they are not used only in oral, but can be used in parenteral, topical or ophthalmic formulation,” says Dr. Ali. “Therefore, the quality of these excipients is of utmost importance critical because of their impact on the development of drug products.”

Other examples of BASF’s multifunctional excipients are:

- Kollicoat IR for immediate-release coating is comprised of polyvinyl alcohol grafted with polyethylene glycol (3:1), and has been marketed in several drug products and is monographed in the USP and Pharm. Eur., as well as being listed in the IID. It has low viscosity with higher solid content in coating suspension, can expedite processing time, and save cost as opposed to cellulosic excipients, says Dr. Ali. In addition, it is a peroxide-free binder, and is well suited for drugs susceptible to oxidative degradation. It is also used as seal coat for many of the weakly acidic or alkaline drugs incompatible to pH-dependent functional polymers. Kollicoat IR is also used in 3D printing by fused deposition model (FDM) when combined with the appropriate polymers.

- Kollidon® VA64 is used as a dry binder in direct compression and roller compaction in tableting, but it is also used as a polymeric solubilizer for poorly soluble drugs in hot melt extrusion and spray drying for amorphous solid dispersions of crystalline APIs.

- Kolliphor® HS15 (HLB 16), is a solubilizer, used in parenteral drugs and ophthalmic formulations. It can be used alone or with other solubilizers like Kolliphor P188 parenteral and in self-emulsifying drug systems (SEDDS) for several insoluble molecules.

“Poloxamers such as Kolliphor P188 and Kolliphor P407 also bear multifunctional characteristics for innovative and generic marketed drug products in which they have been used as solubilizers for increasing solubility, wettability, and bioavailability of poorly soluble drugs in oral, parenteral, topical, ophthalmic, and biologics formulations,” says Dr. Ali. “Such enabling diversity in the excipients’ chemistries and functionalities are typical hallmarks of many BASF excipients that bears their acceptances in innovative nanotechnologies for development of drug molecules.”

Croda Intl., Plc: Supporting Global Excipient Development

Concerns, such as drug stabilization, surface adsorption or agglomeration are found throughout the drug development process, especially within biopharma, which reinforces the need to utilize novel and highly functional excipients. It is crucial that the right excipient is adopted to assist in preventing these common issues from occurring. The current palette of excipients has its limitations, and novel excipients, which aid in the delivery of these new therapeutic agents, must be introduced.

“Truly novel chemical entities that have been designed and manufactured as pharmaceutical excipients are exceptionally rare,” says Dr. Iain Moore, Head of Global Quality Assurance at Croda. “Recent examples have incurred large development costs, not least in the demonstration of patient safety, and have been generally underutilized by the pharmaceutical industry.”

Dr. Moore asks: Why would a scientist formulate with a novel excipient knowing the regulatory scrutiny of the marketing authorization dossier may trigger additional questions and delays when using a traditional excipient which would not incur such questions, even if it did not perform as well? He says that, during the COVID-19 pandemic, the acute need for a successful vaccine outweighed any reluctance to use novel excipients, driving the use of the polar lipids developed to encapsulate the mRNA in the COVID-19 vaccine.

“Croda recognizes the difficulties when using and developing novel excipients and the barriers all parties face,” he says. “Excipient suppliers, excipient users, and authorities can collaborate effectively to bring new novel excipients to market. With a delicate precedent set after the development of the COVID-19 vaccine, we see some significant movement in support of the creation of novel excipients.”

In addition, excipient purity comes into play, as the level of functionality can, in many cases, be a direct function of the impurity levels. As the acceleration of examining the purity in excipients heightens, Dr. Sreejit Menon, Research and Technology Manager at Croda, states, “It is important to take all considerations of an excipient into account in its selection to ensure it not only does the job it’s supposed to, but does it at the highest possible level. Thus, high purity versions of existing excipients can help bridge the gap caused by the lack of novel excipients.”

Croda’s proprietary purification processes, which are used to develop its range of Super Refined™ excipients, align with the expanding regulations and investments in innovation seen throughout the industry. “Developed to support the most sensitive of formulations, our growing range of Super Refined™ excipients will continue to support our customers and the growing need to formulate with the purest excipients available, both today and in the future,” says Dr. Menon. “Innovation is at the forefront of our business, and novel excipients play a crucial part in that.”

Daicel: Co-processed Excipients Offer Unique Advantages

A co-processed excipient is a processed excipient with multiple ingredients listed in monographs without chemical bond, providing new functions that cannot be achieved with individual ingredients. Dr. Yukiko Suganuma, Pharma Solutions, Daicel Corp., says co-processed excipients offer unique advantages. First, the safety of co-processed excipients is linked to the safety of each individual ingredient included as a raw material. This offers advantages in terms of safety compared to a novel chemical substance, and results in fewer barriers to apply novel co-processed excipients to drugs.

Second, co-processed excipients are applicable to continuous manufacturing. “In order to achieve continuous manufacturing for high quality drugs, high quality ingredients are required,” says Dr. Suganuma. “There is concern that slight lot-to-lot variations of multiple ingredients may affect product quality in a continuous manufacturing process. We are confident that co-processed excipients could contribute to stabilizing quality in continuous manufacturing because they are designed to adjust the lot-to-lot variation.”

Daicel’s co-excipients, GRANFILLER-D™ and HiSORAD™, are suited for orally disintegrating tablets. “These co-processed excipients are applicable to continuous manufacturing, while maintaining good compactability, and rapid disintegration,” he says.

Evonik: Polymeric- and Lipid-Based Platforms Address Current Excipient Problems

Many excipients are opening exciting opportunities for drug developers. One area that has been catapulted into the spotlight thanks to the Covid-19 vaccines are the lipid drug delivery platforms used for transporting mRNA and nucleic acids. Among the lipid delivery platforms, most innovation is taking place with ionizable lipids. However, other lipids such as cholesterol – which Evonik offers as the plant-derived PhytoChol® – has a crucial role in improving the stability of LNPs and can improve the overall encapsulation payload. There are also structural lipids, such as DSPC and PEG-lipids, which are particularly important for supporting the stability of the LNPs. Furthermore, the PEG lipids help to stabilize LNPs during particle formation and control the size of the particles. For many types of lipids, Evonik has development and manufacturing capabilities.

In addition to lipid drug delivery platforms, there are other exciting opportunities regarding excipients. For example, customization is a valuable approach when aiming to expand existing excipient options. “The wide range of standard polymers are good for screening broad material properties, but product realization often requires further tailoring of functional excipient properties,” says Jay Stone, MS, Global Product Manager, Excipients, Parenteral Drug Delivery Solutions, Evonik Health Care.

Evonik can customize its LACTEL® and RESOMER® polymers to address limitations of standard excipients. And, over the past 10 years, Evonik has expanded the RESOMER portfolio to address many formulation challenges. RESOMER Zero offers a virtually tin-free excipient enabling formulation with actives that are sensitive to degradation with residual tin catalyst. RESOMER Sterile provides formulators with the option to process formulations aseptically where typical terminal sterilization methods are not feasible.

RESOMER Select allows for full polymer customization. Various options include copolymer composition, molecular weight, and end group chemistry. Furthermore, the degradation properties can be tuned to increase hydrophilicity by incorporation of PEG segments. These polymer properties can be tailored to create a design space for the formulation and defining critical quality attributes.

Also interesting, says Mr. Stone, is the blurring of the lines between polymeric and lipid-based excipients. One example is the Charge Altering Releasable Transporters (CARTs) that have been developed by Stanford University. “These molecules have a polymeric biodegradable backbone, but with lipid-like behavior that can be used to complex nucleic acids, such as mRNA, and deliver them to various tissues – not just the liver as is the case for the mRNA-LNPs,” he says. “We anticipate continued and growing research and investments in these types of excipients that can address problems that current excipients cannot solve.”

Gattefossé: New Chemistry Innovation

Like novel excipients, co-processed excipients are in need of a pathway for regulatory approval. Gelucire® 59/14, for example, is obtained by blending two known IID listed excipients. “To address this challenge, excipient providers have introduced excipients with certain modifications, but that still conform to existing monographs (i.e., Gelucire® 48/16),” says Ron Permutt, Senior Director, Pharmaceutical Division, Gattefossé.

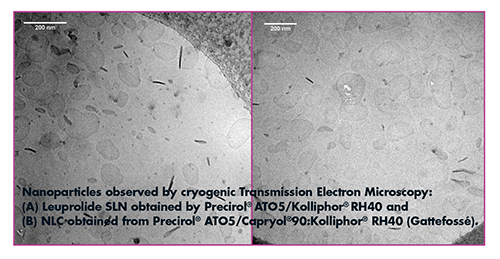

On the other hand, well-characterized multifunctional excipients, which have global regulatory and safety acceptance, are indispensable tools in the development of novel drug delivery systems. Examples include versatile excipients like Compritol® and Precirol®, used in direct compression as lubricants and in prolonged-release systems, solvent-free coatings, melt congealing, and granulation systems. Other key applications in which Compritol and Precirol are used include development of solid lipid nanoparticles and nano lipid carriers, and when combined with other solid and liquid excipients, deliver peptides like leuprolide.

Gattefossé excipients, notably Labrasol®, Labrafac®, and Labrafil® series, are currently in commercial products and late-stage clinical development projects to enhance small- molecule drug solubility and permeability across biological barriers as well as peptides via inter- and intra-cellular pathways.

Over and above excipient quality, safety, and regulatory acceptance is need for innovation in the form of new excipient chemistries and modified existing excipient chemistries, says Mr. Permutt. “Excipient innovation is key to shaping the way drug products are developed, as in the case of charged lipids, which help encapsulate mRNA in COVID-19 vaccines.”

Lubrizol: Novel Polymers Enable Efficient Solubility Enhancement with Established Techniques

Poor aqueous solubility is an established and growing challenge in formulation development. While there are several approaches to addressing poor solubility, many novel techniques involve complex manufacturing processes that are difficult to optimize.

“Novel excipients for solubility enhancement are an appealing option because they leverage established formulation techniques, giving drug products a clear path to scale-up and commercialization,” says Nick DiFranco, Global Market Segment Manager for Oral Treatments, Lubrizol Life Science Health. For example, Lubrizol’s Apinovex™ Polymer enables highly loaded, stable oral amorphous solid dispersions via spray drying. In a case study, Apinovex™ formed a homogenous amorphous solid dispersion of itraconazole at 80% loading, which was two times the highest loading reported in literature, says Mr. DiFranco. “Efficiency gains like this may allow formulators to develop smaller, easier-to-swallow tablets, use less expensive API per dose, or develop differentiated, patent-protected formulations.”

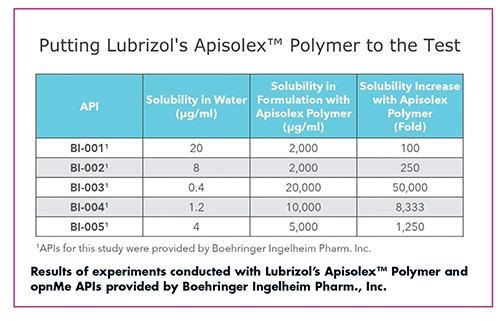

Another example is Lubrizol’s Apisolex™ Polymer for use in injectable drug products. A simple mixing process followed by filtration and lyophilization results in a stable drug product that can increase the solubility of drugs by up to 50,000-fold, says Joey Glassco, Senior Global Market Manager for Parenteral Drug Delivery, Lubrizol Life Science Health.

The polyamino acid-based Apisolex Polymer is a novel chemistry that serves as a non-toxic, non-immunogenic, biocompatible, and biodegradable alternative to PEG, explains Ms. Glassco. The polymer enables up to a 50,000-fold increase in API solubility and results in drug products with reconstitution times of less than 30 seconds in saline. “Using novel excipients such as Apisolex, formulators can not only achieve technical benefits such as solubility enhancement and high drug loading, but they can also improve the overall patient experience,” she says.

After learning of Boehringer Ingelheim’s (BI’s) open innovation collaboration effort with its opnMe program, Lubrizol reached out to BI to explain the benefits of injectable-grade Apisolex to increase the solubility of active pharmaceutical ingredients by nano-encapsulating the APIs in micelles. BI provided Lubrizol with five APIs, BI-0001 – BI-0005, which were known to have low aqueous solubility.

“Lubrizol formulated the five APIs with Apisolex and six other solubilizing excipients showing that only Apisolex polymer was able to consistently solubilize the BI actives to produce viable drug products,” says Ms. Glassco.

Further, Lubrizol analyzed the increase in solubility that the polymer was able to provide and found that Apisolex was able to increase the water solubility of these APIs by up to 50,000-fold.

“With excipient-led approaches to solubility-enhancement, formulators can simply integrate new options into their existing screening programs, saving time and resources during development,” says Mr. DiFranco. “In addition to processing benefits, excipient suppliers are also able to adjust polymer properties to better serve specific APIs. Formulators equipped with several customizable excipient chemistries in early development have more flexibility in addressing solubility and bioavailability challenges.”

Total Page Views: 7740