Issue:May 2021

PRODUCT DEVELOPMENT STRATEGY - ESCP, Estimating Product Performance Part 3 – Mind the Axle

INTRODUCTION

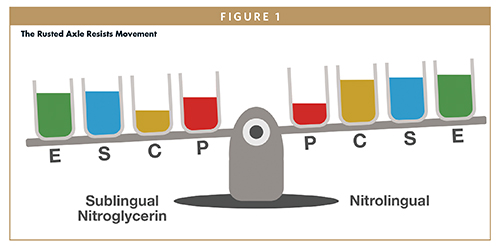

In Parts 1 and 2 of this series, the concept of seesaws, buckets, playgrounds, and leverage were introduced as a model for visualizing the dynamics of pharmaceutical product success. The four key parameters represented as buckets were labeled as E-Efficacy, S-Safety, C-Convenience and P-Price. Arranging them on the seesaw and filling them in proportion to their comparative benefit made it possible to estimate the potential success of a new product concept.

THE AXLE

An important contributor to seesaw performance is the axle or pivot and its relative resistance to movement. Walking into a school playground, it is likely the seesaws have not been particularly well maintained, and there is more than a little rust on the hinge, some of which has been removed with regular use. Rust can make it difficult for a seesaw to easily respond to weight differences on either side. In the case of a schoolyard, this is probably a good thing, slowing down responsiveness, if only a little. In the case of pharmaceutical products, friction at the axle can be either useful or not, depending on a company’s interests.

THE RUSTY AXLE

Rusty axles in the pharmaceutical sector are generally associated with mature and often low-value indications that see little incentives to innovate has resulted in these seesaws being tossed out or smoothed with new product introductions, sometimes with the benefit of “lubrication.”

A classic example of a rusty axle is the seesaw associated with treatment of angina pectoris with nitroglycerin. The use of nitroglycerin for the treatment of acute anginal attacks goes back to 1878 and its use by William Murrell. The date of the first introduction of a sublingual nitroglycerin tablet is lost in history, but the product was subject to US Drug Efficacy Study Implementation (DESI) regulation, suggesting it was introduced at some point between 1938 and 1962, perhaps earlier. Regardless of when, the use of the sublingual nitroglycerin became a staple of medical practice for the better part of the 20th Century. Its use extended to popular culture with the image of a middle-aged man clutching his chest and reaching for his “heart pill.”

Sublingual nitroglycerin tablets, despite being very efficacious, have suffered from issues of ease of use; dig out the container, take out a single tablet, and then place it under the tongue. Carrying the tablets in a container in a pocket for immediate use, or storing in any type of warmer environment, results in a surprisingly rapid loss of potency. The Efficacy of sublingual nitroglycerin was good, if “fresh.” Safety and Pricing were acceptable, but Convenience was not ideal.

That there was an opportunity to improve upon this was recognized by the German-based company Pohl-Boskamp that in 1985 introduced in the US a much more convenient and stable sublingual spray formulation of nitroglycerin, Nitrolingual.

Despite sublingual nitroglycerin being largely unpromoted, Nitrolingual was never able to make much headway in the market. Being a small new company with relatively limited resources, they ran into a seesaw where the axle was rusted and largely frozen in place.

Physicians who had experience and comfort with sublingual nitroglycerin were not inclined to consider a new product that was arguably better without some sort of a push. The axle of the seesaw was effectively covered in rust. Getting the seesaw to move would take a much greater weight on one side, or some lubrication. Pohl-Boskamp and their licensees never had the necessary resources to properly lubricate the axle or the product “weight” to overcome the resistance. While exact figures are not readily available, it is likely Nitrolingual never reached $20 million in annual sales in the US despite some 5 million annual prescriptions written for sublingual nitroglycerin.

THE GREASED AXLE

Getting an axle to pivot with little friction can be the result of heavy use, the addition of lubricant, or both. A good example of well-greased axles can be found in situations, or seesaws, in which there is generic competition.

Generics by definition are the exact same product as the brand but with a lower price. While there may be examples in which a higher priced product can maintain a significant market share in the consumer drug sector in the face of generics, that is rarely the case with prescription medications. Even a small difference in pricing tips the seesaw to the benefit of the generic.

The prescription market is both well-greased and well-worn when it comes to the entry of generic products. It is almost as though play has shifted to a new seesaw, a high-performance one that is tuned to respond to the even the slightest difference in “weights.”

All of this is reflected in the current reality that with the entry of multiple generics, a branded product can lose as much as 90% of its prescription market share within months. The only practical way for branded products to compete is to adjust their price and re-establish a more favorable balance.

GREASING THE AXLE AND SHIFTING BUCKETS

Up to this point, there has seemingly been little accounting for the impact of marketing and promotion in general on the balance of the seesaw. The axle is where promotion has its primary impact, greasing the action and shifting buckets.

Assuming the information provided to the medical community is consistent with a product’s approved label, all that promotion can really do is make the market, or in this case a particular seesaw, more sensitive to even slight differences in the bucket weights, individually and in total. A prescriber cannot weigh the benefits of a new product versus what they already use if they don’t understand a new product’s benefits. Promotion and marketing can help get the message out and frame the benefits of a product in absolute and relative terms.

While considering the market and opportunity for an individual product as competing on a single fixed seesaw is the simplest model; the reality is that each prescriber and formulary will have their own perception of the fill of each bucket and the relative position of buckets on a seesaw. Moving an Efficacy bucket closer to or further away from the axle will alter the balance of the seesaw. In this way, advertising and a salesperson can tailor a message to physicians and decision makers in line with their preconceived notions, or even help them to rethink their sense of “balance.” While the level of each bucket should be consistent between impartial observers based on objective published data, the reality is that perceptions can be “influenced.” In time though, the “true” benefits of a product, and how it compares to other products, is revealed with time if there isn’t some sort of a “thumb on the scale.”

The very best development plan identifies and validates the key benefits of a new product. Attention still needs to be paid to “greasing” the axle so that the benefits in performance can be fully assessed by prescribers and payors. The increasing trend toward independent bodies evaluating the relative value of new products, including Pricing, has made this even more important.

PULLING IT TOGETHER

These are the core concepts necessary to do a “quick and dirty” evaluation of a new product opportunity. How does a product compare head-to-head with a competitor in terms of the four primary characteristics – Efficacy, Safety, Convenience and Pricing? How rusted is the axle? Will it readily respond to the weight of new product benefits, or will it require greasing? In the case of an existing product facing a new and “improved” competitor, the challenge will be to increase friction in the axle and rearrange the buckets to improve comparative performance. Improvement of course is relative, and each prescriber and payor will have an opinion that can be influenced.

Perhaps the benefit of doing a Seesaw analysis early in development is understanding the core parameters and benefits that impact market success. If a new product profile lags in the area of Efficacy or Safety, how can the development plan be adjusted to better demonstrate any benefits the new product might have? Is Pricing the only adjustable parameter? Convenience is an obvious benefit that many companies are exploiting successfully. Both Convenience and Pricing unfortunately offer much less leverage than improvements in Efficacy and Safety.

In the next article, I will review the increasingly common approach of building a new seesaw and sometimes a whole new playground. If you build it, will they come?

Total Page Views: 2374