Issue:November/December 2013

MARKET BRIEF - The Market for Type 2 Diabetes Therapeutics - Key Findings From a Recent Analysis of Global Drug Development Efforts

INTRODUCTION

Type 2 diabetes is one of the most significant global health concerns of modern times. According to the International Diabetes Federation, more than 317 million people have been diagnosed with diabetes, and an additional 187 million are living undiagnosed. No longer a disease exclusive to developed countries, type 2 diabetes is rapidly overwhelming developing countries, such as China and India, as more and more countries adopt the westernized lifestyle that largely contributes to the increasing prevalence. The global revenue earned from drugs sales to treat type 2 diabetes was approximately $36.89 billion in 2012. The rapidly increasing incidence and prevalence globally is predicated to drive this figure to approximately $68.42 billion by 2017. The market for type 2 diabetes therapeutics in China is growing rapidly and is expected to outpace Europe to become the second largest market by 2017. South Korea and Vietnam are also forecast to experience rapid growth.

The market for diabetes drugs has many barriers to entry, particularly for the insulin segment, which requires a great deal of specialization. Due to the chronic nature of the disease and the numerous co-morbidities that make this patient population particularly sensitive to long-term drug safety, the clinical and regulatory hurdles are considerable, and the inherent risks involved, including failure to receive marketing approval after a relatively large investment of time and money, limit this market to those organizations with the necessary expertise and capital. However, the immense size of the potential market has stimulated a vast and growing pipeline of potential new therapies aimed at meeting the unmet needs of tighter glucose control, improved safety profiles, and greater convenience to patients. The following summarizes key findings of Frost & Sullivan’s recent analysis of the type 2 diabetes therapeutics market, which examines in detail the insulin and non-insulin segments of this market on a global level.

NON-INSULIN THERAPEUTICS

Non-insulin anti-diabetic drugs are mostly oral therapies and are typically prescribed as first-line therapy when diet and exercise alone are insufficient to control elevated blood glucose. Non-insulin therapeutics can be sub-segmented into standard of care (SOC) therapies and add-on to SOC.

The main drug classes prescribed as SOC are all available as low-cost generics and are composed of biguanides (metformin), sulfonylureas (glipizide, glyburide, gliclazide, glimepiride), and alpha glucosidase inhibitors (acarbose, voglibose, miglitol). In the US and most of the world, metformin is the gold standard first-line therapy. Add-on therapies, which are composed of newer novel drug classes, are typically prescribed in combination with SOC when those treatments eventually fail to control elevated blood glucose on their own. Add-on therapies can also generally be prescribed as first-line or monotherapy when SOC therapies are contraindicated or not well tolerated. The main drug classes used as add-on therapies are meglitinides, glitazones, incretin-based therapies composed of glucagon-like peptide-1 (GLP-1) analogues or receptor agonists, dipeptidyl peptidase-4 (DPP-4) inhibitors, and the newest class, sodium-glucose co-transporter 2 (SGLT2) inhibitors. The meglitinides, of which there are two marketed drugs: Novartis’ Starlix (nateglinide) and Novo Nordisk’s Prandin (repaglinide), are post-meal glucose-lowering therapies and are a relatively minor portion of the market. Santarus’ new diabetes product Cycloset (bromocriptine), launched in 2010, is a novel first-in-class oral antidiabetic (OAD) based on the circadian rhythm of dopamine activity. Cycloset also has a minor share of the market, but is gaining ground as physicians become more familiar with its unique mechanism. The glitazones, also known as thiazoladinediones (TZDs) or PPAR gamma agonists, represented by Takeda’s Actos (pioglitazone) and GlaxoSmithKline’s Avandia (rosiglitazone), were former blockbusters until the recent emergence of serious safety issues and have since seen significant declines in sales, restraining overall revenue growth for the segment. However, the segment was soon revived and stimulated by strong uptake of Novo Nordisk’s Victoza (liraglutide, a GLP-1 receptor agonist) and continued strong sales of Januvia, along with the introduction of additional members of the DPP-4 class and the initial launches of a new class, the SGLT2 inhibitors. In 2012, the majority of global revenue generated for the non-insulin therapeutics segment was from sales of Januvia, as well as metformin, the most widely prescribed diabetes therapeutic worldwide.

The recent implication of increased risk of pancreatic cancer in the incretin-based therapies, such as Januvia and Victoza, has drawn considerable media attention but is not expected to have a significant impact on the market overall in light of the lack of compelling data in support of the theory. The European Medicines Agency (EMA) and the US FDA each initiated an investigation of the matter in March 2013, and both agencies have recently (July 2013) announced they have found no confirmed link between incretin therapies and increased risk of pancreatic cancer. This is good news for the manufacturers of the numerous GLP-1 therapies coming to market. While this class has been long dominated by Byetta (exenatide) and Victoza (liraglutide), several rivals are arriving to the market, the most advanced of which is Sanofi’s Lyxumia (lixisenatide), currently under review by the FDA with a decision expected in December 2013 or early 2014. Lyxumia, developed by Zealand Pharma and commercialized by Sanofi, is already approved in Mexico, Australia, Europe, and, most recently, Japan. GlaxoSmithKline is also awaiting FDA approval for their once-weekly GLP-1, albiglutide, with a decision expected in April 2014. Most anticipated, however, is Eli Lilly’s dulaglutide, a once-weekly GLP-1 with strong positive data that is poised to be a formidable competitor to all of the GLP-1s including Victoza. Dulaglutide could launch as early as late 2014 or 2015.

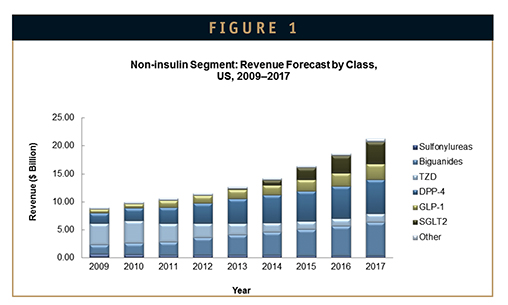

While Januvia and the DPP-4 class are expected to continue to dominate the non-insulin market for the foreseeable future, the SGLT2 class is forecast to overtake the GLP-1 class for the number two spot among add-on therapies by 2015, in light of important class-associated clinical benefits, such as weight loss and lowering of blood pressure, along with convenient once-daily oral administration and potent glucose lowering. An additional benefit of the SGLT2 class is its mechanism involves increasing glucose excretion, rather than affecting glucose production or insulin sensitivity, making it a potentially important insulin-sparing drug for type 1, as well as type 2 diabetics (Figure 1).

Almost every add-on drug class can be combined with the gold standard therapy metformin, and most are offered as both stand-alone therapies, as well as fixed-dose combinations with metformin. Moreover, different drug classes can typically be prescribed as part of double or triple combination therapy, thus expanding the potential market for each, as well as stimulating partnerships between owners of complementary therapies. A recent example of such a strategic partnership is the agreement between Merck and Pfizer to co-commercializePfizer’s SGLT2 inhibitor, ertugliflozin, as well as develop a fixed combination of ertugliflozin with Merck’s DPP-4 inhibitor, Januvia.

Complementary and/or synergistic combination therapies are frequently the goal of diabetes drug developers because most diabetes patients will progress through therapeutic regimens of increasing potency. Additionally, the inconvenience of taking multiple pills can have a significant negative impact on patient compliance with their therapy, making double- or triple-fixed combinations in a single pill (while keeping the pill size manageable) an attractive option for patients and physicians.

Metformin therapy may be significantly improved in the near future with the anticipated introduction of Elcelyx Therapeutics’ alternative metformin formulation dubbed NewMet(TM) currently in Phase II. Elcelyx has capitalized on their proprietary gut-targeted drug delivery platform to enable the targeted delivery of metformin to the gut tissues, where they believe it exerts its effect. This spares the body from systemic exposure and enabling therapeutic efficacy with a much lower dose and greatly improved tolerability, which is key as approximately 20% to 30% of patients do not tolerate metformin.

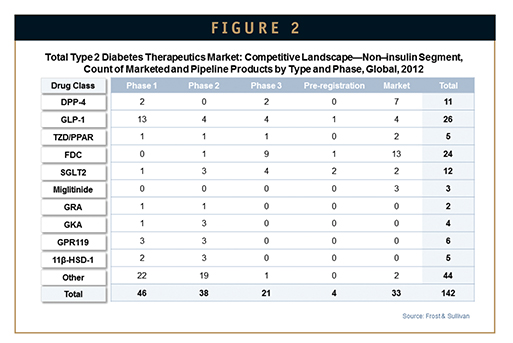

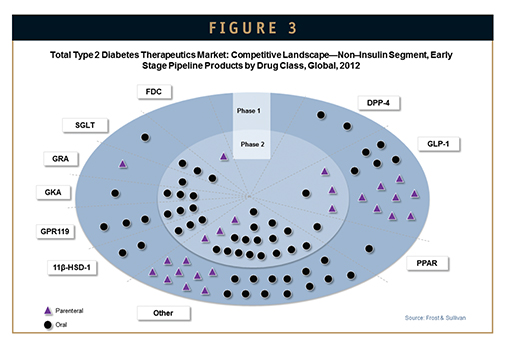

The development pipeline for non-insulin diabetes therapies is rich with potential new drugs, with more than 100 candidates identified at various stages of development. Early development compounds primarily belong to the GLP-1 class, as well as miscellaneous novel targets, such as GPR119, 11β-HSD-1, and glucagon receptor agonists, while late-stage compounds are primarily in the SGLT2 and GLP-1 classes (Figures 2 & 3).

INSULIN SEGMENT

Insulin therapy is typically reserved for the more advanced stages of the disease and is intended to compensate for the inadequate production of, or sensitivity to, endogenous insulin. In type 1 diabetes, insulin therapy is essential. The two main categories of insulin are human insulin and modern insulin. Human insulin is made by recombinant biotechnology and is molecularly identical to endogenous human insulin. Regular human insulin is a rapid-acting insulin, whereas intermediate-acting or pre-mixed human insulins have an extended pharmacokinetic profile due to formulation enhancements.

Modern insulins can be sub-segmented based on their pharmacokinetic profiles into rapid-acting or mealtime insulin, pre-mixed or intermediate acting, and long-acting or basal insulin, and each serves a distinct purpose. Rapid insulin is intended to mimic and supplement the body’s normal release of a “spike” of insulin upon ingestion of nutrients: hence the term mealtime insulin. Rapid and ultra-rapid insulins are insulin analogues engineered for rapid absorption via strategic substitution of one or two amino acids. This results in prevention of the formation of hexamers, a normal action of injected regular insulin, which slows the absorption. Rapid insulin is typically administered three times daily with meals.

Basal, or long-acting insulins are insulin analogues engineered for slow, continual release and are intended to provide steady 24–hour glucose control. Basal insulin is injected once daily, although longer acting once-weekly versions are in development. For many patients initiating insulin therapy, basal insulin alone might be adequate; for others, rapid insulin, in addition to basal insulin, is needed.

Intermediate-acting, or pre-mixed insulin is intended to provide mealtime control, plus control for several more hours. Pre-mixed insulins, which are composed of generally 30% rapid insulin and 70% regular or long-acting insulin, can handle glucose spikes plus additional control for a several hours. Intermediate-acting insulin, such as human insulin NPH, is regular insulin formulated for slow release over a period of 6 to 10 hours.

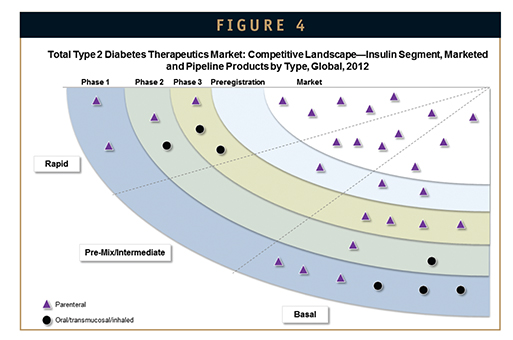

The insulin market has seen a resurgence of activity in recent years with promising new products, such as ultra-rapid-acting and liver-targeted insulin analogues, and insulin-plus-GLP-1 combinations in late-stage development. Earlier-stage candidates include several oral formulations, as well as ultralong–acting insulin analogues. Some ultralong-acting insulin analogues in development have the potential to greatly reduce the dosing frequency to just once weekly for basal insulin needs, as opposed to once daily (Figure 4).

Ultra-rapid-acting insulins, such as Novo Nordisk’s FIAsp, which is just beginning Phase III trials in Q3 2013, promise to offer tighter glucose control and greater convenience to patients. Both Novo Nordisk and Eli Lilly are developing liver-targeted insulin analogues, which, according to the data so far, will have greatly improved efficacy profiles because they have a more physiologically relevant mode of action with subsequent benefits, such as weight loss and lower risk of hypoglycemia (dangerous drops in blood glucose). Eli Lilly’s liver-targeted insulin analogue LY2605541 (insulin peglispro) is the most advanced, currently in Phase III of development.

Novo Nordisk’s IDegLira, a combination product of Tresiba (insulin degludec) and Victoza (liraglutide), boasts a superior efficacy profile with its complementary action of long-acting insulin plus GLP-1 therapy, a combination long considered by many in the medical community to be the optimal therapeutic approach among all known drugs. Tresiba has been approved in Europe but has been delayed in the US due to a surprise request from the FDA to conduct a cardiovascular outcomes trial. Therefore, filing for approval of IDegLira in the US will have to wait for the green light for Tresiba; however, European approval and launch is expected in 2014 following the June 2013 application with the EMA. Sanofi is also working with Zealand Pharmaceuticals on a similar combination product, combining Lantus (insulin glargine) with lixisenatide in a fixed ratio delivery. Phase III trials for the combination product, dubbed LixiLan, are planned to start in 2014.

The insulin market generates slightly less than half of the total revenue for the type 2 diabetes therapeutics market. However, in general, it is growing faster compared to the non-insulin market worldwide, in developed regions like the US and Europe, as well as developing markets like Korea, where younger patients in particular are becoming more cautious about controlling their blood sugar and tend to prefer insulin over OADs to avoid complications. Although oral insulin will probably not completely replace injectable insulin (at least in the foreseeable future), the availability of an insulin pill would be welcomed by both type 1 and type 2 diabetics, as both of these patient types expressed a strong desire for oral administration of their diabetes treatments in a recent Frost & Sullivan patient preference study of drug delivery methods.

SUMMARY

The market for type 2 diabetes therapeutics is uniquely characterized among therapeutic areas in its widespread global prevalence with a richness of untapped markets, diversity of established and potential drug targets, and significance of regulatory hurdles. Significant gaps in diabetes management left by currently available therapies, such as tighter glycemic control with low or no risk of hypoglycemia, greater convenience of therapy, and durable, personalized treatments that attack the root cause of the disease with disease-modifying properties create a vast opportunity for innovative drug developers to successfully penetrate this lucrative expanding market.

Debbie Toscano is a Senior Industry Analyst with the Frost & Sullivan North American Healthcare practice. Utilizing more than 20 years of life sciences industry experience, she maintains particular expertise in analysis and interpretation of scientific data as well as preparation of deliverables with attention to technical detail. Mrs. Toscano has an experience base covering a broad range of sectors, including focus on diabetes and metabolic diseases, cardiovascular diseases, and preclinical animal modeling and pharmacology. Prior to joining Frost & Sullivan, she conducted preclinical research with Novartis Pharmaceuticals. Mrs. Toscano earned her BS from Delaware Valley College in Biology and her Master’s Certificate from Thomas Edison State College in Clinical Trials Management.

Total Page Views: 8208