Issue:March 2018

GLOBAL REPORT - 2017 Global Drug Delivery & Formulation Report: Part 1, a Global Review

By: Kurt Sedo, VP of Operations, and Tugrul Kararli, PhD, President & Founder, PharmaCircle

Part 1: A Global Review

Part 2: Notable Product Approvals of 2017

Part 3: Notable Transactions and Technologies of 2017

Part 4: The Drug Delivery and Formulation Pipeline

Introduction

With the books closed for 2017, we can take a closer look at pharmaceutical product approvals for the year. In a series of articles through the next four issues, we will review 2017 with an emphasis on pharmaceutical products, technologies, transactions, and a look forward to 2018 and beyond with a review of the current clinical pipeline. The overall focus of this article series will be on drug delivery and formulation technologies and products, plus a peek at what is unfolding in the field of gene and cell therapy. In this first installment, we look at the macro aspects of the 2017 product approvals.

Considerable attention is placed on new molecular product approvals, with too little time spent on repurposed versions of previously approved actives. A closer look at dose-modified products often provides a better sense of what the future holds. There is much less risk associated with applying a novel technology to a previously approved active; one less variable to juggle. Once validated, it becomes much easier to rationalize applying a next-generation technology, with next-generation benefits, to a novel molecular entity.

Product Approvals in the USA

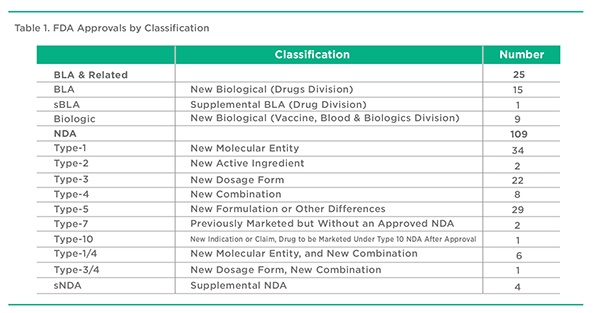

The US FDA provides a variety of approval types for pharmaceuticals and medical devices. These range from New Drug Approvals (NDAs) to Abbreviated New Drug Approvals (ANDAs) to Biologic License Approvals (BLAs) to Premarket Approvals (PMAs) to 510(k) approvals. This last group, 510(k) approvals, are new products approved on the basis of their functionally similarity to products approved prior to 1976. These 510(k) approvals along with PMA and ANDA approvals are ignored in this review. BLAs include well characterized therapeutic agents from both the Drugs and the Vaccines, Biologics & Blood Divisions. Within the NDA classification, there are a variety of Types of approvals. Most attention is placed on Type-1 approvals that apply to new molecular entity (NME) products. Often overlooked are the Type-3 New Dosage Form, and Type-4 New Combination Approvals. These approvals often point to new pharmaceutical approaches in terms of drug delivery, formulation, and therapeutic treatment strategies. While Type-5 approvals at times embody interesting formulation approaches, they often represent approvals for new products with little or no novelty. This is particularly the case with multisource generic injectable approvals, which are required to use the NDA 505(b)(2) rather than the ANDA pathway for approval. For the purpose of this article, multisource injectable 505(b)(2) Type-5 approvals have been excluded from the analysis.

Another wrinkle concerns the approval of Supplemental NDAs and BLAs that do not qualify as a new product but can represent a new dosage form. These products have been selectively included in the analysis where they represent important new dosage forms. For consistency, PMA and 510(k) approvals, largely device approvals, have been ignored even though they may at times include a drug component.

Based on the aforementioned defined criteria, a total of 134 products were included in this review of 2017 FDA approvals. These approvals covered the Drugs, Vaccines, Biologics & Blood Divisions of the FDA. Of this total, 64 approvals represent NMEs. The remaining 70 approvals represent new formulations of previously approved products, new combinations of previously approved products, or some other category as noted in Table 1.

Product Approvals in the European Union

Properly analyzing product approvals in Europe is trickier. While the US has a single regulatory body covering the sale of pharmaceuticals to some 320 million people, the European Union (EU) boasts more than 500 million people and a variety of regulatory bodies approving products at a pan-European and individual country basis. For the purpose of this review, products approved by the European Medicines Agency (EMA) were included in the analysis. This analysis may overlook some notable products approved at the country level but deciding which should and shouldn’t be included would result in an unreasonably biased dataset. The dataset used for the 2017 EU approvals was drawn from the PharmaCircle Pipeline & Products Intelligence module and cross referenced with the PharmaCircle EMA module. Using the PharmaCircle dataset provides important benefits, most notably an expanded and consistent set of individual product characteristics. The EMA and FDA provide datasets with limited individual product information that the PharmaCircle analysts expand upon by analyzing individual products to tease out additional information that ranges from product formulation details, to molecule type, to dosage form, to injection route.

The EMA dataset does not provide the same detail as the FDA dataset in terms of approval types. Despite this shortcoming, it is possible to do a detailed analysis of EMA product approvals by examining individual product characteristics. A total of 62 product approvals are included in the analysis and represent new molecular entities as well as novel formulations of previously approved actives approved by the European Medicines agency.

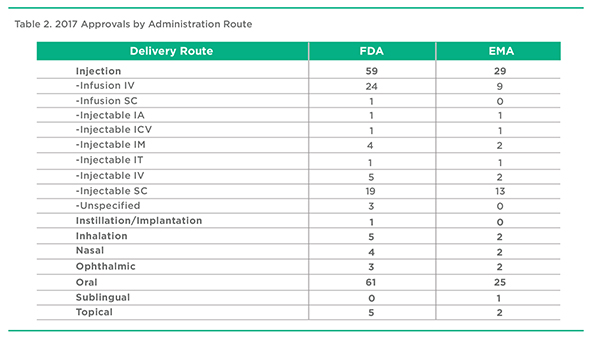

2017 Approvals by Administration Route, FDA & EMA

A summary of product approvals by Administration Route is presented in Table 2. The distribution is largely consistent between the EMA and FDA approvals. Oral delivery accounted for about 40% of approvals in both territories. Summed together, Injection-based delivery accounted for almost the same number of approvals. The remaining delivery routes, Inhalation, Nasal, and Topical accounted for no more than a low single-digit percentage of all approvals.

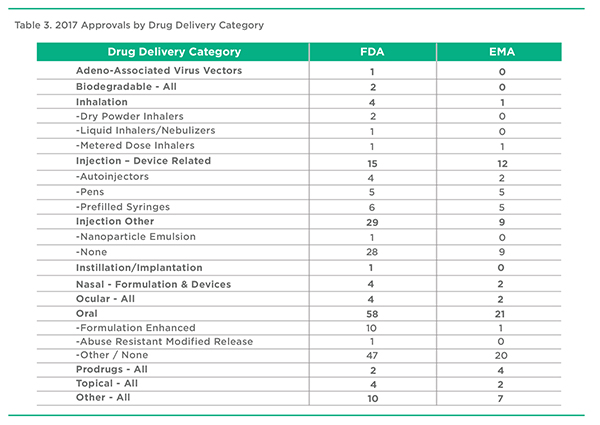

2017 Approvals by Drug Delivery Category, FDA & EMA

This is a PharmaCircle-defined series of pharmaceutical product designations that help define and categorize products in terms of their essential drug delivery characteristics. Table 3 is an abridged version of the full list of 70 or so separate categories. Perhaps the most notable point is that formulation enhanced oral products represented a surprisingly small proportion of all approved oral products in 2017, certainly in comparison to a decade ago. Have we moved past “peak oral formulation”? Is the reduced interest in enhanced versions of multisource actives a result of fewer new product ideas or the relatively low period of exclusivity available in the absence of strong technology or molecule patents? Another interesting point not obvious in Table 3 is that 2017 went by without another transdermal new product approval.

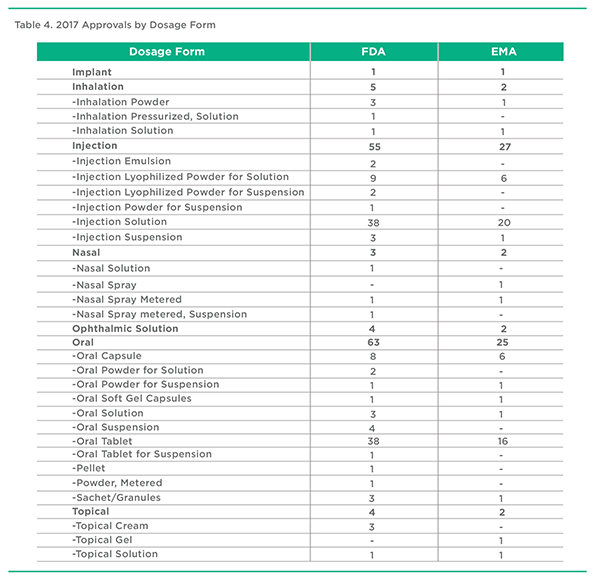

2017 Approvals by Dosage Form, FDA & EMA

The relationship between Administration Route, Drug Delivery Category, and Dosage become more obvious as one looks at the data. Products administered by Inhalation or Injection, for example, are composed of a variety of different dosage forms using different drug delivery technologies. Examining approvals, and the development pipeline, can provide insights into where the industry is headed and where opportunities exist for drug delivery and formulation enhanced therapeutics.

It’s worth noting that in the case of Injection, while there is considerable attention being placed on patient-friendly subcutaneous drug-device pairings, less attention is being placed on dosage form and drug delivery technology enhancements, with most products using simple Injection Solution approaches. The most common oral dosage form continues to be the Oral Tablet, with only a smaller proportion incorporating any type of drug delivery technology.

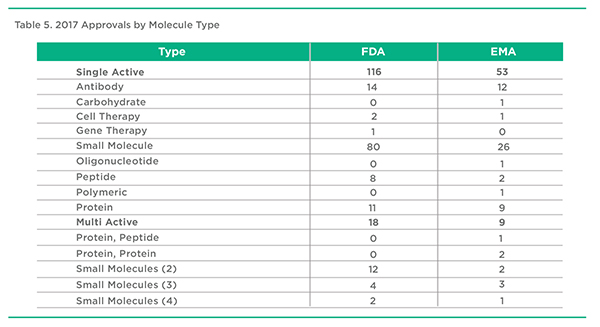

2017 Approvals by Molecule Type, FDA & EMA

Once again, small molecule therapeutic approvals in 2017 represented the largest number of product approvals followed by antibody therapeutics moving up the ranks in terms of total approvals. It’s hard to remember that 3 decades ago, antibodies were considered to be a major disappointment in terms of therapeutic products. Perhaps the situation is repeating itself as we witness the approval of an emergence of gene and cell therapy therapeutics following their apparent crash and burn 2 decades ago. Oligonucleotide and carbohydrate therapeutics meanwhile continue to try and find a meaningful role.

Combination products, beyond the traditional antihypertensive and diuretic and more recently antidiabetic and metformin pairings, have increased in terms of numbers and variety. The intended benefits of these products range from improved convenience to improved efficacy, especially with anti-infective and respiratory products.

2017 Approvals — Reflections

From a macro perspective, 2017 was in many ways a repeat of 2016 in terms of total approvals and approval types. There was an overall increase in NME approvals, in part a result of more orphan product approvals, and of course cancer product approvals. Surprisingly perhaps, infectious disease products were in second place in terms of the number of FDA product approvals, behind cancer products. The cardiovascular product approval numbers were on par with endocrinology products, largely treatments for diabetes. The emergence of gene and cell therapy products as meaningful therapeutic options for the treatment of poorly managed medical conditions was perhaps the most notable trend of 2017, if not yet reflected in the approval numbers.

There was activity in the area of respiratory therapeutics with the introduction of new dry powder devices being applied to previously approved therapeutics, some of which provided the convenience of three medications in a single device.

One therapeutic area that saw a relative drop in approvals was oral opioids. With the public scrutiny of opioid prescribing, the industry came to understand that abuse-deterrent properties, as evidenced by Opana ER, were not a hedge against misuse and censure. But opportunity is often revealed by studying the details. In the next installment, we look at individual product approvals to see what is revealed by examining the 2017 approvals at the micro level.

Total Page Views: 4620