Issue:May 2013

FORMULATION DEVELOPMENT - A Call for Collaboration to Meet the Bioavailability Challenge

When asked to deliver a column on solubility enhancement, I gladly accepted. I am passionate about this area in particular, and at a higher level, with the common goal of advancing compounds to the clinic and marketplace. A column with this focus has the potential to give all of us who deal with bioavailability challenges an opportunity to share ideas on where we stand, and then brainstorm how we might pull together to overcome the barriers we face. As a first step, I thought I would identify a few of the key issues, and then follow this in subsequent columns with thoughts and ideas from different perspectives about what can be done to advance the science, technologies, and methodologies beyond “challenges” or “concerns” to real implementation. An issue of considerable interest to me is the standardization of approaches for solubilization based on rigorous science.

I want this column to become a forum for discussion among and between pharmaceutical companies, the CROs and CMOs that serve them, the excipient providers that are an essential piece of the puzzle, equipment and lab instrumentation manufacturers, and universities that contribute to advancing the science and technologies we leverage. I personally believe collaboration will lead to breakthroughs to advance our segment of the pharmaceutical industry to the benefit of all.

No inaugural article in this space would be complete without the motivation of why solubilization is emerging as a concern now shared by an increasing number of us. I believe we all know this, so I’ll try to be brief and provide an overview that justifies the importance of this topic for our industry and the patients we serve. After this first column, and based on input you provide, I hope to increasingly incorporate thoughts, ideas, and diverse frames of reference in order to better inform us all. So I’ll paint the picture as I see it today, and look forward to getting your input so we can gain new insights with the goal of developing a richer understanding of where we are, how we got here, and how we can progress.

COMPOUNDING PROBLEMS

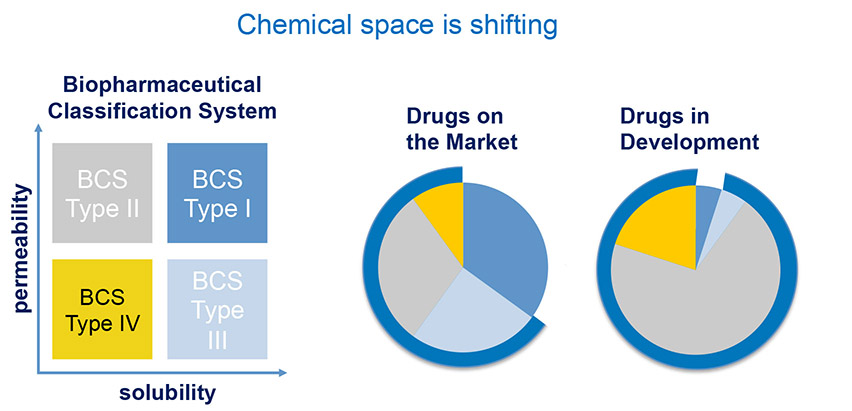

It’s estimated that more than 40% of APIs today have solubility challenges in early development. Looking at drugs previously brought to market compared with drugs under development, there is a shrinking number of APIs that fall into the range of being both highly permeable an highly soluble. Based on estimates done by Benet, Leslie Z. and Wu, Chi-Yuan in late 2006, and using the Biopharmaceutical Classification System (BCS), the most soluble and permeable compound type (BCS Type I) accounts for approximately 35% of marketed drugs, but for only 5% of drugs in the development pipeline. With such a large percentage of APIs requiring bioavailability enhancement – and the most challenging compounds (BCS Type IV) accounting for more than 20% of these, we’re all faced with a significantly changing drug delivery landscape.

Due to the increased complexity of the diseases we are addressing today, it appears that solubility challenges are not a fad but rather firmly rooted in physical chemistry and biology. And as discussed in the interview published in the April issue of this publication, “Solubilization: Accessing Broader Chemistries by Integrating Fundamental Science With Automation for Greater Predictability”, there’s growing consensus that achieving the required potency and selectivity mandates carefully engineered hydrophobicity. This requirement gives rise to an increasing number of compounds with low intrinsic bioavailability.

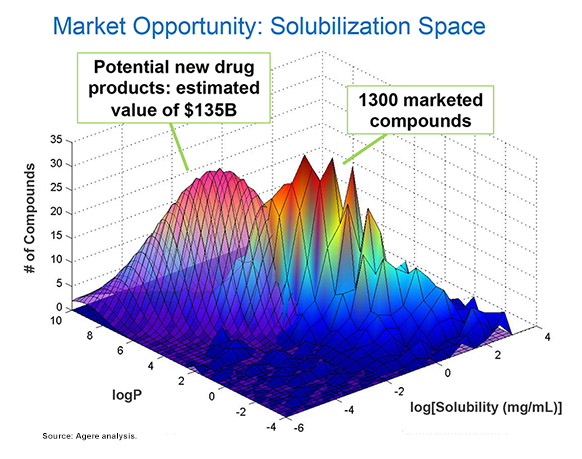

FIGURE 1.

R&D INVESTMENT VS. SUCCESS

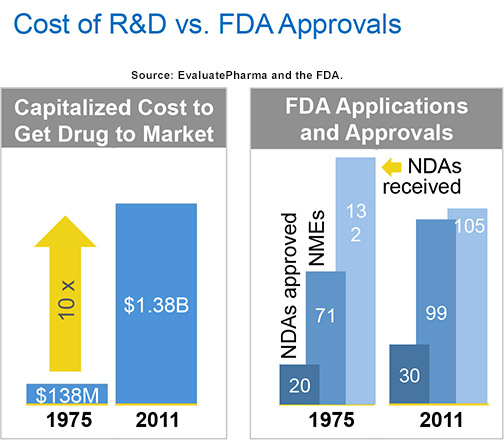

For the industry as a whole, R&D investment is increasing, and yet FDA approvals are in decline. According to the European Federation of Pharmaceutical Industries (EFPIA), the global R&D spend in 2010 climbed to more than $120 billion from under $70 billion in 2002. This increase is highly correlated to the cost to develop a new drug, which in 2011 was $1.38 billion, a ten-fold increase in less than 40 years based on estimates from EvaluatePharma. But according to FDA reporting, the number of FDA approvals of new drugs and NMEs throughout that same period has only grown by 50% and 40%, respectively.

We might take solace in the fact there’s a higher success rate today in terms of NDA applications vs. approvals, growing to a ratio of just over 5:1 in 1975 to 3:1 in 2011, but with a capitalized R&D cost increasing by 900% in the same period, it’s hardly comforting.

FIGURE 2.

LACK OF PREDICTABILITY

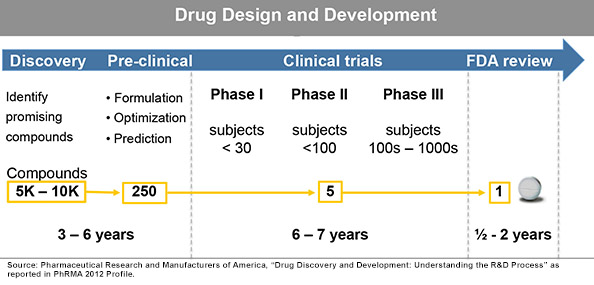

The attrition of promising APIs as they progress from discovery into preclinical and then through clinical trials remains high. Recent estimates reported in PhRMA’s 2012 Profile of the Pharmaceutical Industry show a continuing trend of the difficulty faced when trying to accurately predict how drugs will perform as they move toward the clinic. Even after extensive investment of money and time before entering Phase I trials, evidence shows that the lack of predictability for efficacy and toxicity is clearly the most pressing challenge of all.

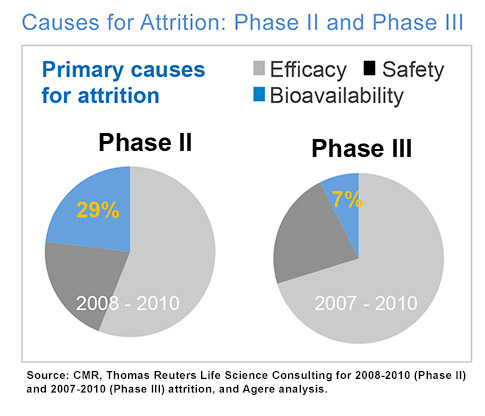

However, the attrition of drug candidates isn’t solely due to lack of efficacy or unforeseen toxicity. We estimate that almost 30% of APIs have been historically lost during Phase I & II clinical trials due to bioavailability, and a remaining 7% in Phase III.

The poor bioavailability of these drugs should be predicted and rectified with robust formulation approaches as early as possible. Clearly, this is the goal for every company, and our industry’s pursuit of better prediction is partly evidenced by the significant R&D investments that continue to chase what may appear to be elusive solutions. In fact, it may be time for us to audit our current approaches, as in many cases, there may be significant improvements that can be found.

FIGURE 3.

SOLUBILIZATION APPROACHES

Throughout the past 50 years, numerous approaches have been develope to improve the solubility of intrinsically insoluble compounds. By far, the most common approaches are salt forms. However, many other methods have been successfully applied. Other platforms include: co-crystals, co-solvents, complexing agents, lipid-based vehicles particle size reduction, solid dispersions, and surfactants. Each approach has its own set of advantages, and the selection process to identify the optimal platform for any particular compound can be daunting. While it is in principle possible to screen each of these approaches for viability using a brute force method, it is often not practical from a cost, time, and API availability perspective. Nor should it be necessary. More fundamental understanding is needed industry-wide to relate the properties of a given compound to the preferred formulation platforms. Further, we should never be satisfied with “this formulation worked best” without analyzing “why.” Our past successful experiences and assumptions about “why,” and what can and cannot work may themselves be barriers to our progress as they often preclude us from taking a more scientific and objective approach.

FIGURE 4.

THE OPPORTUNITY

I realize we may not be able to improve the return on R&D investment and the success rate for APIs for the whole industry, but it’s certainly worth our while to focus on tackling bioavailability issues. Agere has done an analysis of th potential impact of collaborating to overcome the challenges we currently face, and we believe there is a significant and as-to-date unrealized market opportunity. As reported in the aforementioned April interview, we’v performed an analysis on a database containing data on more than 1,300 marketed drugs. We explored what the impact might be if we could shift the distribution slightly, to a lower solubility and higher water-octanol partition coefficient, and then assume similar numbers of compounds compared with historical records. This can be accomplished leveraging today’s more modern solubilization technologies and approaches, and by our estimates, would enable approximately 450 new and yet-tobe- discovered compounds to enter the market.

We estimate this represents an expansion of the market by 35%, which translates into an opportunity of $135 billion in today’s dollars.

WHAT WILL IT TAKE?

To start things off, I thought I’d summarize my thoughts about what could have significant impact on advancing solubilization technologies. This is not an exhaustive list, but I hope that this will stimulate thought and conversation toward our shared goal for improved solubility prediction, which promises to reduce R&D spend and time to market.

Innovation

We need to innovate at every stage, but with consideration for the ultimate goal: that is, local optimization in a global context. Progress is possible if we tackle problems that are both critical and solvable, and simplify them using fundamental science and robust approaches. Our success at innovatio will strongly correlate with the level of discipline and structure we can impose on the problem and solution space, and integrating an awareness of the impact an isolated change will have on subsequen stages in the development process. Shared understanding of the APIs, excipients, and solubilization technologies at a fundamental level will be essential. Part of this will involve more distributed knowledge about of the variables and complexities being faced by those in our ecosystem and those whose work comes before and after ours. In other words, we need to apply what we have learned in the past to today’s problems. In general, I believe that we as an industry spend far too much time re-hashing the same issues that have been solved by great science and scientists in previous decades. You may have had a similar impression at a recent conference.

Specification

Detailed specifications at the beginning of the formulation development process would increase the probability of satisfying solubility requirements. While it is almost never possible to completely define the requirements for bioavailability improvement, dose, etc., it is essential that every effort be made to define our goal. In addition, such specifications should include information regarding the company’s best practices and preferences. This information will serve to constrain and guide formulation design and optimization. How detailed and under what context this information is provided is for another discussion, but a more formalized approach to using specifications to constrain and put discipline into the flow from drug substance to drug product in the clinic will help us all efficiently identify which formulation approaches have a greater chance for success, and which have a higher risk profile.

FIGURE 5.

Standardization

Given the interdependence of the players in our industry, standards on many levels could have great impact. Detailed descriptions of the chemical properties of excipients that enable apples-to-apples comparisons would enable formulators to do rigorous modeling and testing to seek the best excipient candidates for a given API. Empowered in this way, formulators can rationally explore excipients based on specifications for the drug performance and commercial image.

Exploration

Specifications and standardized information about APIs and excipients will facilitate a broader and more agnostic explorations of platforms and excipients that fall into the “most likely to succeed” category for every compound. Each compound is chemically unique, and armed with the same level of information about the drug requirements and a broader set of platforms and excipient candidates will enable a more comprehensive and unbiased exploration for the best solution.

Design Automation

Today’s complexity of bringing modern medicines to the clinic exceeds the abilities of any one person or team to apply an empirical approach, based on what’s worked in the past. This method alone clearly isn’t delivering the innovations and efficiencies demanded in 2013 and beyond to achieve a successful drug product. With specifications and standardization, formulation design automation could be enabled to facilitate fast, rigorous, and accurate in silico exploration of combinations unimagined today. This will be the underpinning that delivers greater predictability, translating into a higher-proportion of drug candidates that successfully navigate through the clinic.

Going Forward

In subsequent columns, I plan to present other ideas and opinions on what it will take to tackle the challenges we face, and any other bioavailability-related subject matter of interest to the DDD readers. To initiate this interactive and collaborative process, please send me your reactions, thoughts, and suggestions so we can a start the dialogue. I look forward to hearing from you (see my bio for contact information), and together moving our part of the industry toward a new era. Toward solubility success!

Dr. Marshall Crew is President and Founder of Agere, a leading CRO/CMO focused on improving the oral bioavailability of insoluble APIs. The company supports clients from formulation design and development through cGMP manufacturing for Phase I through Phase IIb clinical trials. Agere is expert in spray drying and amorphous technologies, and at in vivo study design and interpretation. Dr. Crew has devoted his career to improving oral bioavailability, developing innovative technologies and approaches for the delivery of poorly soluble drugs and then managing their application to achieve client success. Prior to Agere, he was VP of Chemical and Biological Sciences at Bend Research. Dr. Crew’s scientific expertise includes formulation design and development, solid state characterization of drug substance and product, and computational modeling (predicting shelflife and pharmacokinetic and bioavailability for oral, devices, and parenteral delivery). He is a world expert in the design of API physical properties to optimize efficacy and overcome PK and delivery constraints. Over 27 patents and patent applications have been issued or filed under his name on various drug delivery platforms, including controlled release, nanotechnology, and solid dispersions. Dr. Crew earned his PhD in Physical Chemistry from Oregon State University, and is a member of Agere’s Board of Directors. He can be reached at crew@agerepharma.com or LinkedIn: https://www.linkedin.com/profile/view?id=17815140.

Total Page Views: 3237