Issue:September 2018

DRUG DEVELOPMENT - Cell & Gene Therapies Calling for Innovation in Drug Development

INTRODUCTION

Decades in the making, the promise of cell and gene therapy research is finally poised to deliver results. Products including Kymriah, Yescarta, and Luxturna are now on the market, and many others are in late-stage clinical development. There are now clinical-stage development programs in gene therapy targeting almost 50 different diseases, up from 10 only a few years ago.1 While US and EU companies (53% and 32%, respectively) are sponsoring most of these programs, others are underway in China and South Korea.2

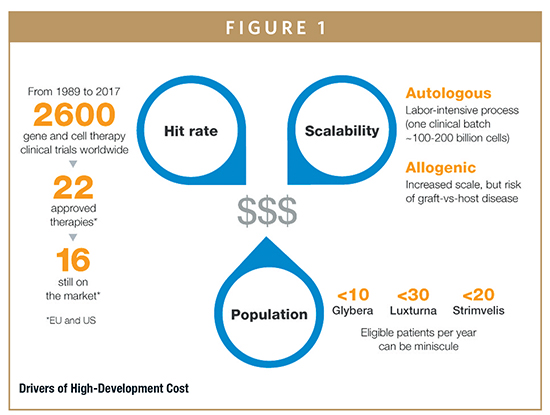

The prospect of a generation of new cell and gene therapies introduced in succession, many of them offering potentially curative efficacy, is obviously good news for many patients, but it also presents many significant considerations for the optimal strategies in drug development. Challenges can include the need for highly specialized expertise, limited production capabilities, small patient populations, and, in some cases, single-dose delivery to patients. Products might also have to be reviewed and approved based on data from small patient populations. Lack of robust and statistically significant data can raise concerns among clinicians, patients, and investors. As progress continues, the need to develop and implement the innovative business models that can address these issues is fast becoming a critical need for industry and for health systems, clinicians, payers, investors, and other stakeholders. The path forward may require untried strategies to help drug developers advance high-risk clinical programs to commercialization.

THE SEARCH FOR EXPERTISE & PRODUCTION CAPACITY

Many companies working to develop new cell and gene therapies face challenges in building teams with the specialized expertise they need and in accessing production capabilities to meet demand at every stage. Unlike development of small molecules, where the path from discovery to clinical development is fairly standardized, the development path and timelines for gene and cell therapies can vary widely. One critical issue is identification of the optimal drug delivery mechanisms. For many advanced therapies, the precise mode of drug delivery cannot be confirmed until late in the development process, making later-stage research much riskier. For gene therapies based on nucleic acids, for example, it is often difficult to determine how to stabilize these molecules long enough for them to take effect. It can also be difficult to confirm whether viral vectors used in cell and gene therapies present a risk of immune response or other unwanted side effects in patients.

New levels of complexity in drug development require highly specialized expertise and technology to support both research and manufacturing. For example, very few biotechnology companies have the in-house skilled professionals and technology to produce their own viral vectors. Among those that do, it is often unclear whether they can expand production to meet global demand for their products. Limited options for third-party production of viral vectors can also mean that many development programs will face significant delays and unpredictable manufacturing costs.

CHALLENGES OF PERSONALIZED MEDICINES

The fact that many cell and gene therapies are personalized medicines that are produced for each patient can also put pressure on costs compared to small molecule drugs. With most small molecules, the cost per unit will decrease as production levels rise, which can play an essential role in commercial planning. But these benefits are often not achievable with personalized medicines. For example, while the emerging generation of CAR T cell therapies shows significant promise in treating a range of cancers, these drugs are developed using a complex process to produce a drug for each patient while also often targeting very small patient populations. Costs associated with commercial production therefore typically cannot achieve significant economies of scale. Additionally, curative therapies administered in a single dose do not allow costs to be recovered based on multiple doses administered over months or years.

Many curative therapies could also face stringent regulatory requirements and substantial costs to monitor and validate efficacy and safety over the long-term. This can require collection and analysis of real-world data from patients during or after a course of treatment. While the FDA recently issued a plan to expedite the review of gene therapies for certain diseases to help support drug innovation, it also requires sponsors to observe subjects for potential treatment-related adverse events for at least 15 years, with a minimum of 5 years of annual examinations.3,4

NEW LEVELS OF COMPLEXITY IN CLINICAL RESEARCH

For cell and gene therapies to treat rare diseases, it can be especially difficult to identify appropriate patients for clinical research and connect them with available treatment centers. Small patient populations can also impose limitations on clinical data that, while sufficient to support approval, may affect clinician and patient confidence. When a gene therapy for lipoprotein lipase deficiency was pulled from the market after treating only one patient, the treating physician cited concerns about the clinical data from research based on just 27 patients with no control group. Many other clinicians appeared to be hesitant to prescribe a drug based on results from a trial that was widely viewed to be underpowered.5,6

In late 2017, the FDA issued guidance to help address the lack of available patients for research in rare diseases by encouraging extrapolation of data across different populations, increased use of models and simulations, and use of a single control group as the basis for more than one investigational drug.7 While these modifications could help a greater number of development-stage programs advance to the regulatory finish line, there is a concern that they could also create an over-reliance on computer simulations, potentially even in cases where more traditional or reliable data sources are available, or lead to safety and efficacy results that are less statistically sound than current industry standards.

THE NEED FOR NEW DEVELOPMENT MODELS

Many established and emerging challenges in development of cell and gene therapies are in place even as several therapies are positioned for commercial availability. As a result, many companies are working aggressively to identify the new approaches in clinical research that can effectively support these development programs. One example is the focus on platform diversification. In contrast to single-target small molecules or monoclonal antibodies, many gene and cell therapies have the potential for a diversified development platform with a unifying focus. When Alnylam Pharmaceuticals discontinued its development program for revusiran for the treatment of hereditary ATTR amyloidosis with cardiomyopathy (hATTR-CM), the company was well positioned to adapt the platform to target other diseases, such as hereditary TTR-mediated amyloidosis and acute hepatic porphyria. The ability to pivot and apply one cell or gene therapy development program to different therapeutic areas could present new growth opportunities or mitigate risk for many companies.

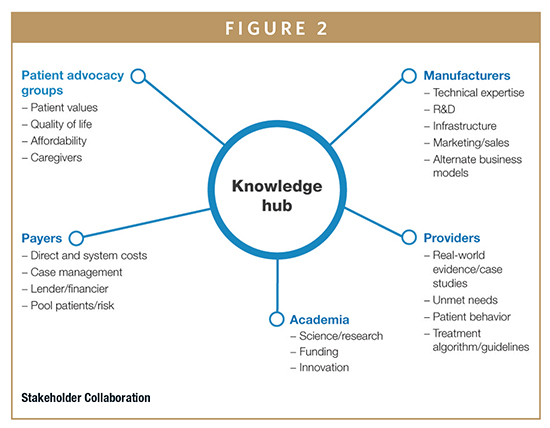

To promote knowledge sharing and allow for more rapid technological advances in gene and cell therapy, industry leaders are also now considering new approaches in stakeholder engagement. Some examples include the models used in the Human Genome Project or the International Rare Diseases Research Consortium.8 Structuring development programs to engage a range of healthcare stakeholders — potentially including manufacturers, academic research centers, payers, providers, charitable organizations, and patient advocacy groups — can help facilitate innovative solutions and help align diverse but similar gene and cell therapy research efforts. These collaborations can lead to new options in raising capital, build stronger awareness among patients and clinicians, facilitate broader sharing of data, accelerate translational research, and support development of essential manufacturing and processing technologies. The involvement of stakeholders spanning different geographies could also strengthen efforts in global access and help companies address post-marketing requirements in patient surveillance.

Broader access to government funding to support high-risk translational research and drug development programs is another potentially effective option. New models might include direct public funding to manufacturers as an avenue for development of gene and cell therapies, as opposed to the use of publicly funded discovery to feed private development of novel therapies. This approach might better reflect the potential global impact of many gene and cell therapies, especially those positioned to deliver curative benefit to patients and health systems.

Manufacturers might also consider expanding academic partnerships and leveraging financing from charitable foundations to pursue development of higher-risk gene and cell therapies. Examples of this strategy are already emerging. Orchard Therapeutics recently launched a transformative gene therapy development program in partnership with a range of research organizations, including UCLA, Boston Children’s Hospital, University College London, Great Ormond Street Hospital for Children NHS Foundation Trust, and the University of Manchester. The program will exploit ex-vivo autologous stem cell therapy technology for the potential treatment of a range of primary immune deficiencies, metabolic diseases, and hematological disorders.9

As the rate of innovation continues and potentially increases in the years ahead, more established companies may also see benefit in partnering with and nurturing early stage gene and cell therapy assets. For example, a company with a robust portfolio of immunology assets might wish to engage with synergistic discovery stage platforms to expand their model to include next-generation curative therapies. Celgene’s acquisition of Juno Therapeutics and Gilead’s acquisition of Kite Pharma are recent examples of larger companies that have expanded their pipelines in this way. In addition to new assets, these alignments can bring established companies different technology platforms that can further expand and accelerate future drug development efforts.

SUMMARY

There is significant evidence to indicate that we are entering a golden age of gene and cell therapy development. While industry works to advance these programs, the debate over new approaches in both structuring and financing clinical research is likely to continue. Solutions might involve strategic partnerships and collaborations among a broader range of stakeholders, but these complex alignments will, of necessity, require new levels of risk- and responsibility – sharing. Efforts to modify clinical and regulatory standards to address the unique factors associated with development of cell and gene therapies can also play an important role. If successful, it is possible that many of the promising development programs currently underway, and more to be initiated, will reach commercialization and bring advanced therapeutic options to thousands of patients who need them.

ACKNOWLEDGMENTS

The authors wish to acknowledge the contributions of Walter Colasante, Stephanie Donahue, and Michael Krepps to this article. The views expressed herein are the authors and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.

REFERENCES

- Emily Mullin, “Gene Therapy 2.0,” MIT Technology Review, March/April 2017, available at https://www.technologyreview.com/s/603498/10-breakthrough-technologies-2017-gene-therapy-20/.

- Grace Gu, “Even With High Costs & Uncertainty, Gene Therapy Finds Funding and Warm IPO Waters,” Crunchbase News, available at https://news.crunchbase.com/news/evenhigh-costs-uncertainty-gene-therapy-findsfunding-warm-ipo-waters/.

- FDA, “FDA announces comprehensive regenerative medicine policy framework,” press release, November 16, 2017, available at https://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm585345.htm.

- FDA, “Guidance for Industry – Gene Therapy Clinical Trials – Observing Subjects for Delayed Adverse Events,” November 2006, available at https://www.fda.gov/downloads/BiologicsBloodVaccines/Guidance-ComplianceRegulatoryInformation/Guidances/CellularandGeneTherapy/ucm07719.pdf.

- Gina Kolata, “New Gene-Therapy Treatments Will Carry Whopping Price Tags,” New York Times, September 11, 2017, available at https://www.nytimes.com/2017/09/11/health/cost-gene-therapy-drugs.html.

- Antonio Regalado, “The World’s Most Expensive Medicine is a Bust,” MIT Technology Review, May 4, 2016, available at https://www.technologyreview.com/s/601165/the-worlds-most-expensive-medicine-isa-bust/.

- FDA, “FDA In Brief: FDA recommends new, more efficient approach to drug development for rare pediatric diseases,” press release, December 6, 2017, available at https://www.fda.gov/NewsEvents/Newsroom/FDAInBrief/ucm587862.htm.

- J.P. Tremblay, et al., “Translating the Genomics Revolution: The Need for an International Gene Therapy Consortium for Monogenic Diseases,” Letter to the Editor, Molecular Therapy, February 1, 2013, available at http://www.cell.com/molecular-therapy-family/molecular-therapy/abstract/S1525-0016(16)30585-8.

- Orchard Therapeutics, “Orchard Therapeutics launches and announces academic partnerships for development of transformative gene therapies,” press release, May 3, 2016, available at http://www.orchardtx.com/2016/05/orchard-therapeuticspress-release/.

To view this issue and all back issues online, please visit www.drug-dev.com.

Lev Gerlovin is Vice President in CRA’s Life Sciences Practice. Mr. Gerlovin has more than 11 years of experience in life sciences strategy consulting, focused on commercial and market access strategies. He has worked with a diverse set of clients, including leading pharmaceutical and biotechnology manufacturers, distributors, health plan providers, and industry groups. Mr. Gerlovin also has experience in a broad range of therapeutic areas, particularly in neurology, endocrinology, central nervous system, infectious diseases, oncology, rheumatology, and rare diseases.

Dr. Pascale Diesel is Vice President in CRA’s Life Sciences Practice. Dr. Diesel has 18 years of pharmaceutical and biotech experience in global development, marketing, planning, and business development and more than 10 years of strategic consulting experience focusing on portfolio optimization and valuation. Prior to joining CRA, she was Principal, Strategy, and Portfolio Analysis, EMEA at QuintilesIMS (now IQVIA), concentrating on commercial due diligence (sell- and buyside), sustainable growth, and geographic expansion.

Total Page Views: 9513