Issue:September 2020

DRUG DEVELOPMENT - Bringing New Drugs to Patients Faster by Integrating Traditionally Separate Pharma Development Functions

INTRODUCTION

Speeding novel or improved drugs to the patients who need them is, of course, the be- all and end-all of pharmaceutical research and development (R&D). The $2.6-billion estimated cost of new drug development makes efficiency critical as well.1 Reducing R&D project timelines saves on overhead in development while increasing the likelihood of primacy in the marketplace, which engenders significantly more sales. Therefore, increasing R&D efficiency makes sense from both humanitarian and business standpoints. The following describes new approaches drug developers are taking to streamline drug development.

SOME SENIOR PHARMA DECISION-MAKERS ARE RETHINKING HOW THEIR COMPANIES TACKLE R&D

Over time, pharma leaders have tried various ways to shorten development timelines by integrating process segments that have traditionally been separate. For instance, clinical research organizations (CROs) have integrated clinical activities with data sciences and biological and bioanalytical providers, resulting in a coordinated offering that simplifies clinical research.

Similarly, contract development and manufacturing organizations (CDMOs) have combined active pharmaceutical ingredient (API) synthesis and contract development with manufacturing of drug products to reduce downtime related to coordinating activities and transitioning from vendor to vendor.

Some companies have reorganized by expanding their API businesses to include drug product manufacturing. Meanwhile, other drug product businesses have taken on API production to streamline combined development and manufacturing. A 2017 study of one such program compared multi- and single-vendor CDMO models on cycle times and development economics.2 The conclusion was that the single-vendor model could expedite the development of potentially life-changing therapies and save sponsors up to $45 million per drug through reduced time to market.2 These examples demonstrate how the industry has been employing a variety of tactics to integrate various workflows and processes, aiming to streamline drug development.

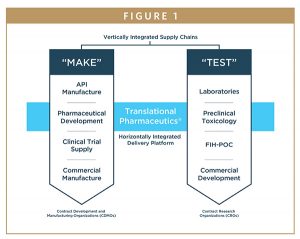

THE NEXT LOGICAL STEP: HORIZONTALLY INTEGRATE CLINICAL RESEARCH WITH DEVELOPMENT & MANUFACTURING FUNCTIONS

The latest development in this trend toward greater efficiency is the integration of clinical development and manufacturing capabilities into a single drug development program. Traditionally, multiple vendors (several CROs and several CDMOs) would be employed to undertake separate development activities. The idea behind integration is that dovetailing clinical activities with clinical manufacturing will improve decision-making and increase speed and flexibility for developing investigational drug products. Ultimately, making therapies available to patients, faster, without compromising quality or safety.

HURDLES TO SHORTER TIMELINES & HIGHER SUCCESS RATES

In general, alongside high and ever-increasing costs, these common pharmaceutical development productivity pain points must be addressed:3

Challenges That Result in Long Timelines

Challenges in development and optimization of new clinical formulations – Ongoing trial results may dictate unanticipated alterations in dosing or formulations. For example, first-in-human (FIH) trials often reveal that the new drug molecule has suboptimal bioavailability — requiring time-consuming reformulation prior to use in subsequent, proof-of-concept (POC) clinical trials.

Lack of flexibility to respond to indicated changes – Changing dosages or formulations post-POC and in life cycle management activities usually means returning to the manufacturer for a new product development program and clinical trial manufacturing campaign. However, when clinical trials have begun, only clinical drug products already manufactured and approved can typically be used — in other words, it is neither simple nor easy to introduce a new dosage form partway through a trial. This lack of flexibility causes serious delays, with gaps of weeks to months between production and dosing — extra weeks or months that delay bringing an improved therapy to those in need. Additionally, the new formulation’s deviation from the original protocol becomes a time-consuming regulatory issue that must be resolved.

Need to transition to a clinical cGMP process – The simple formulations for FIH studies are often prepared by pharmacies. These products may include drug-in-capsule or basic solutions or suspensions that allow maximum dose flexibility, which is important in the Phase 1 setting. However, as a molecule progresses in development toward POC patient trials, it is important to transition to a dosage form that delivers the drug optimally, is stable, and can be shipped to patient sites globally. This dosage form must also be manufactured according to good manufacturing practice (GMP) at an appropriate facility. Each product transition process entails additional time-consuming studies.

Management of multiple vendors – Simply coordinating multiple vendors takes time and effort. In addition, inevitably, there will be a time lag between a project handoff and when the recipient can begin the next stage of development.

Challenges That Result in High Molecule-Attrition Rates

In drug development, early choices may be based on animal model data, which is notoriously less predictive of inhuman results than human data. This suboptimal input and lack of flexibility to change course, mid-trial, lead to a high failure rate for new drugs, particularly late in the game. According to a 2018 MIT study, two out of five drugs that reach Phase 3 will fail.4 This high failure rate factors heavily into the overall cost of drug development — a cost, one way or another, passed on to the public.

THE NEW APPROACH ADDRESSES ALL THESE CHALLENGES

Combining clinical research with development and manufacturing functions addresses many of the challenges encountered in traditional drug development. In this model, production and clinical testing are integrated with single-source, small batch manufacturing. In response to emerging human data, a variety of formulation prototypes with varying technologies can be screened and clinically evaluated in short order, allowing rapid-fire selection, manufacture, and dosing. These efficiencies reduce timelines significantly, lower costs, and increase a drug’s chances for successfully improving human lives. Enabled capabilities include:

-Real-time decisions can be made based on the clinical results

-Formulations can be developed and optimized as the trial progresses

-Scale-up from small batch to clinical manufacturing does not require time-consuming tech transfer to another CDMO

-Costly mistakes and/or rework are avoided

-Compared with the coordination of multiple outsourced partners, assignment of a single vendor and a cross-functional project manager streamlines management

-Better-optimized therapies reach patients sooner

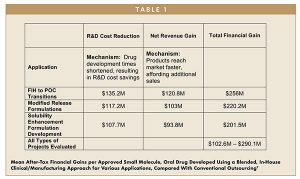

This integrated approach, which our company refers to as Translational Pharmaceutics®, was evaluated in a recent Tufts CSDD study.5 This study found that, compared to industry benchmarks, an approach that integrates clinical and manufacturing functions, on average:

-Reduces development time by >12 months

-Translates into R&D cost savings of >$100 million per approved molecule

-Results in total financial gains of >$200 million per approved molecule, as products reach the market sooner

WHY AREN’T ALL PHARMA COMPANIES TAKING THESE NOVEL, INTEGRATIVE APPROACHES?

Large pharma companies have long-standing, standard ways of doing things they know work. Their focus is on keeping processes moving without complication, so aside from looking for small improvements and optimization, the less they vary their day-to-day procedures, the better able they are to remain productive.

The downside, however, is that this traditional structure is often not flexible enough in modern early drug development, where it is necessary to make swift decisions and pivot quickly. What’s required today is a start-up mindset, like that of small biotech companies. Institutional features enabling the necessary speed to succeed in the current, competitive marketplace include:

-Strong scientific skills and competencies

-Flexible and agile processes

-A culture that encourages innovation, thinking outside the box, and working smarter to adopt tailored/bespoke approaches

In many cases, large pharma companies have noted that a lot of the innovation in drug development and new molecule discovery is coming from small biotech companies. In turn, large pharma is allowing small biotechs to apply their considerable energies to early drug development, and then purchasing the rights to promising new drug candidates. In fact, today, a large proportion of the molecules large pharma companies have in their pipelines were not developed in-house, but were bought from lean, agile biotech companies entirely focused on achieving the next phase of development. To illustrate, a 2019 STAT article lists the provenance of the highest-selling prescription drugs from Pfizer and Johnson & Johnson for 2017.6

SOME VISIONARY LEADERS IN BIG PHARMA HAVE DEVELOPED A WORKAROUND

Large pharmaceutical companies are taking steps to bring new therapies to the world faster by addressing the problem of sluggish R&D. One approach is to carve out a start-up-like division within the larger organization. These separate business units are designed and encouraged to behave like small biotechs. For a handful of new molecules each year — especially those with time pressures or known competition — these innovative programs achieve accelerated development.

One example of this phenomenon is at Eli Lilly. This vast company set up a separate division called Lilly Chorus.7 Chorus teams save time by not having to work with standard Lilly processes — for instance, they have a streamlined QA process especially tailored for POC development. At Lilly Chorus, molecules reach POC much faster than they would within the parent organization’s system. The limited number of molecules selected for development through this model have been very successful.

Another example is Janssen Research & Development, a Johnson & Johnson company, and its WAVE early development unit. Like Chorus, WAVE is a team operating within a larger company that is specifically engineered to execute in a lean, efficient, biotech-like way. This independent unit progresses novel compounds from FIH through initial POC stages. By focusing on key compound developability questions, WAVE scientists produce data that enables robust decision-making. Through this arrangement, Janssen can discover and develop innovative solutions that address unmet medical needs.

Independently operated divisions like these can engage in the kind of agile decision-making necessary for fast, effective early development — even within the confines of a large, less flexible organization.

INTEGRATING CLINICAL & MANUFACTURING ACTIVITIES IS ANOTHER WAY

Engaging a single organization that can undertake multiple development activities may enable pharmaceutical companies to develop their own new medicines and bring them to patients significantly faster. This approach is illustrated by two stages of development, as shown in a recent Tufts whitepaper (referenced in Table 1). The first stage encompasses the initial clinical studies to achieve POC — the transition from Phase 1 to POC. The second stage is the post-POC, in which drug products are optimized for pivotal trials in late clinical development.

Pre-approval R&D cost benefits from faster initiation were substantial. Rate of return analysis on costs and sales found further gains attributable to earlier launch. Through these mechanisms, notable time and monetary savings can be achieved across a broad range of study types, as quantified in Table 1. Enlisting the aid of a company focused on getting work done very quickly by integrating formulation, manufacturing, and clinical testing can shorten development times by more than 12 months.

REAL-TIME ADAPTIVE MANUFACTURING IS EFFICIENT & SPEEDS NEW DRUGS TO PATIENTS

In pharma development, shorter timelines are key. Integrating traditionally siloed functions is one way to streamline the process and bring novel therapies to patients sooner. Enabling research groups to function more like start-ups, regardless of how the rest of the organization operates, can help.

Engagement in real-time adaptive manufacturing can streamline R&D. Compared to a traditional development program, a flexible dosage design complemented by real-time manufacturing of changing dosages and formulations can result in efficiencies that reduce timelines significantly and increase a drug’s chances for success.

The impact of this integrative approach has been quantified across a large portfolio of small molecule, oral dose, early stage clinical drug development projects. Faster initiation of POC and pivotal clinical trials engender real pre-approval R&D cost benefits. Additionally, shorter development times mean earlier arrival to market, resulting in substantial financial gains per approved new drug and streamlined access to new, life-enhancing therapies for patients.

REFERENCES

- DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016;47:20-33. https://doi.org/10.1016/j.jhealeco.2016.01.012.

- DiMasi JA, Smith Z, Getz KA. Assessing the Economics of Single-Source vs. Multi-Vendor Manufacturing. Boston: Tufts Center for the Study of Drug Development. Oct. 2017. Available at: https://static1.squarespace.com/static/5a9eb0c8e2ccd1158288d8dc/t/5aa2ffa7c830258399bddd82/1520631721090/DiMasi_17.pdf. Accessed February 21, 2020.

- DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016;47:20-33. https://doi.org/10.1016/j.jhealeco.2016.01.012.

- Wong CH, Siah KW, Lo AW. Estimation of clinical trial success rates and related parameters. Biostatistics. 2019;20(2):273-286. https://doi.org/10.1093/biostatistics/kxx069.

- DiMasi JA, Wilkinson M. Assessing the Financial Impact of Translational Pharmaceutics®. Boston: Tufts Center for the Study of Drug Development. Oct. 2019. Available at: https://static1.squarespace.com/static/ 5a9eb0c8e2ccd1158288d8dc/t/5db98c66888fb410bd326071/157244204699/Tufts+CSDD+Study_White+Paper+on+Translational+Pharmaceutics.pdf. Accessed February 21,2020.

- Jung EH, Engleberg A, Kesselheim AS. Do large pharma companies provide drug development innovation? Our analysis says no. STAT. Published December 10, 2019. Available at: https://www.statnews.com/2019/12/10/large-pharma-companies-provide-littlenew-drug-development-innovation/#Table1. Accessed February 21,2020.

- Bonabeau H, Bodick N, Armstrong RW. A More Rational Approach to New-Product Development. Harvard Business Review. Mar. 2008. Available at: https://hbr.org/2008/03/a-more-rational-approachto-new-product-development. Accessed May 12, 2020.

- DiMasi JA, Wilkinson M.

To view this issue and all back issues online, please visit www.drug-dev.com.

Dr. Nutan Gangrade is Global Head of Pharmaceutical Sciences at Quotient Sciences and has over 30 years of experience within the pharmaceutical industry. Prior to his current role, he served as Managing Director of Quotient Sciences, Philadelphia, with responsibility for all development and manufacturing operations across two sites. He held the position of Senior Director of Formulation Development at QS Pharma, a US CDMO, where he was also a founding team member. He has previously held positions at Bristol-Myers Squibb (DuPont Pharmaceuticals) and Wyeth-Ayerst Research (American Cyanamid). In these positions, he was the CMC lead for several products in various phases of development. He earned his PhD in Pharmaceutics from the University of Georgia.

Total Page Views: 4299