Issue:January/February 2020

DEVELOPMENT TIMELINES - Drug Development Times, What it Takes - Part 1

INTRODUCTION

It seems simple, you define the various clinical development steps, estimate the time for each step, look for opportunities to overlap the steps, and there you have it, a plan and schedule for clinical development through to approval. But it never works out as you planned, reality always intrudes. Accurately estimating a product’s clinical development timelines is more than simply adding up the individual timelines, almost always optimistic. You need to “know” the numbers, not just calculate them. The good news is that the numbers are knowable if you invest the time to find them and understand what they are telling you.

THE COLLEGE EXPERIENCE

If there ever was a simple timeline forecast situation, it must be estimating the time to complete college, either a 2-year Associate’s or 4-year Bachelor’s program. The very definition of these programs tells you everything that you need to know. Start a 2-year program and you graduate in 2 years. Start a 4-year program and you graduate in 4 years.

That of course is not the reality. On average, only 5% of students complete their Associate’s degree in 2 years. For Bachelor’s degrees, the numbers are a little better, with 19% to 41% of fulltime students graduating in 4 years.1

What explains the discrepancy between forecast and reality? The short answer is life and circumstances. Look a little bit closer, and the reasons could be mistaken for the same reasons that clinical development timelines are delayed – unexpected failure, issues of financing, and changing priorities.

THE PHARMACEUTICAL DEVELOPMENT EXPERIENCE

Why then do companies, particularly emerging biotech and drug delivery companies, continue to plan financings and resource allocations around the often overly optimistic estimates of their development teams without consideration for the experience of those who have gone before?

It has been my experience that development teams, especially in emerging companies, chart the shortest most optimistic path through development and approval for their products. This optimism is reinforced by management who want to present investors and partners with the best possible product scenario. It’s easier to make a business case for clinical development and approval in 4 rather than 6 years. The trouble is that a product re sourced for 4 years will struggle if the program takes 6 years. While it might be argued that the actual out-of-pocket costs will be the same regardless of the actual clinical development timeline, there remain the pesky overhead expenses related to facilities and personnel. In the end, a program always costs more if it takes longer. If not properly anticipated, a longer-than-expected development program can cripple, or even kill, a product and the sponsoring company.

Limited, easily available information may also contribute to why companies rely only on their internal forecasts of development and approval timelines. While the relevant information is available in the public domain, it can be hard to find, process, and properly apply to a particular product development program.

The clinical and regulatory teams may build their plans based on their professional expertise, but it behooves management and investors to have their own forecast of timelines and the related expenses. If the development team expects to complete development through to filing in 4 years and the industry average is 5 years, it would be wise to understand the resources, public relations, and financial implications of the program actually taking the average of 5 years. Even with an industry average of 5 years, half of the programs will take longer than this. How much longer is also an interesting piece of information. Are development times for similar products clustered or spread out around the average? What accounts for the shorter and longer development times?

OVERVIEW – NDA & BLA APPROVALS 2010-2018

Many articles track and discuss New Molecular Entity (NME) approvals in hopes of defining what this means for the industry and investors. This three-part review instead examines the development and review times for all of the FDA’s Drugs Division NDA and BLA approvals in the period 2010-2018 for which public information is available; 900-plus approvals.

One last word, the devil is in the details. As best as possible, I will try and simplify the analyses and provide relevant details associated with these development and review times. In all cases, it is recommended that people who need to understand the details dig into the primary data sources.2

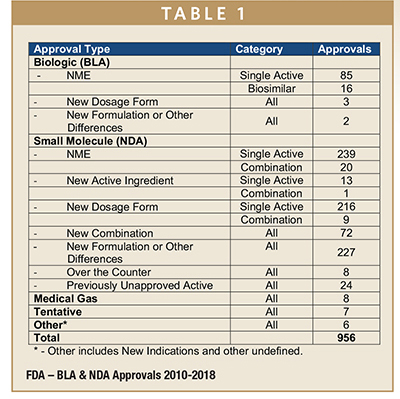

APPROVAL CATEGORIES & TYPES

NDA and BLA approvals can be categorized into two major groups: NME approvals (Drugs and Biologics), and products using previously approved molecular entities. This latter group includes New Dosage Forms, New Formulations, and a limited number of NDA approvals related to New Indications, Approvals for Previously Marketed Products, and Medical Gases.

The distribution of approvals for the 2010-2018 period, a total of 956 approvals, is presented in Table 1 (this does not include approvals from the Vaccine, Blood & Biologics Division of the FDA). The definition of the various Approval Types can be found in FDA reference documents.3,4 Where the FDA product record does not include an assigned Approval Type an appropriate assignment was made consistent with the nature of the approval and other FDA assignments.

NDA and BLA approvals have averaged a little more than 100 annually for the past 9 years. Of this total, NMEs, either as single entity or combination product approvals, accounted for a little less than 38% of the total. New Dosage Form and New Formulation approvals combined accounted for the largest number of approvals, each representing about 24% of the total.

DEVELOPMENT & REVIEW TIMES

Both Development Time and Review Time require a brief definition. The easy definition is Review Time. For the purpose of this article, Review Time is the time that has elapsed between the first submission of a new drug filing, an NDA or BLA, and the date the product is granted first approval by the FDA. In the case of rolling submissions, the “clock” starts on the date of the filing of the first portion of the submission. In the case of a Tentative Approval, the approval date is the date the product is first approved by the FDA, not the second approval granted when patents and other restrictions on commercialization have expired.

Development time as presented in this article is considered as the time elapsed from the start of significant clinical investment. Because the available public information is incomplete and inconsistent, the following definition of Development Time will be used. Development Time is the elapsed time between the earliest of either: Pre-IND Meeting, first IND filing, or the start of the first human clinical trial and the filing of an NDA or BLA.

This loose definition is necessary because of data limitations. In some cases, only one of the three dates is available. In the case of products first developed or approved in Europe, it is obvious that any Pre-IND, IND, or first US clinical date is not relevant to how long the product took to get US approval because of the previous overseas development work. Very few approvals fall into this group.

Development and Review Time is the time elapsed from the start of development as previously defined and first FDA regulatory approval.

OVERALL DEVELOPMENT & REVIEW TIMES

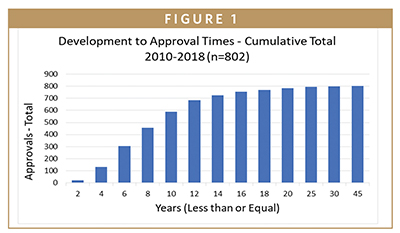

As a reward for getting this far, here is the number you have been hoping for: 8.2. This is the mean average Development and Review Time in years for a company to successfully move a product from the start of the clinical development process through to approval. The median is 7.2 years. This is for the 802 approvals for which the information is available and applicable. The cumulative distribution of the Review and Development Times is presented in Figure 1.

Here are a few more numbers. The mean average Development Time was 6.7 years, and the median was 5.6 years. The mean average Review Time was 1.5 years, and the median was 0.9 years. The mean average Review Time of 1.5 years is deceiving. For the past decade, a complete submission package is reviewed by the FDA in 10 months or less. The 1.5-year mean average is distorted by the many companies that submitted applications that were kicked back or delayed by the FDA for reasons that ranged from data issues to failed facility inspections.

This is just enough information to confuse and distort any quick conclusions you hoped to make regarding Development and Review Times. It’s like measuring the heights of all the people in a town and determining the average height is 4’6”. An interesting data point, but it is much more useful to understand average heights in the context of age and sex. In much the same way, Development and Review Times are only relevant in the context of the well-defined product types described earlier.

In the next two articles, I will tease apart Development and Review Times as a function of the various Submission Classifications (Table 1). Within these classifications, it will be necessary to further parse approvals into those that required safety and efficacy trials, those that depended only on pharmacokinetic and bioavailability studies, and those that required only a literature review. Some received Priority Review, many did not. All of this is important in properly understanding Development and Review Times and their application to real-world development programs.

REFERENCES

- Graduating in 4 years or less helps keep college costs down – but just 41% of students do. https://www.cnbc.com/2019/06/19/just-41percent-of-college-students-graduate-infour-years.html .

- There are a variety of primary resources for FDA development and review time information. The best resource are the product approval document summaries found at Drugs@FDA: FDA Approved Drug Products (https://www.accessdata.fda.gov/scripts/cder/daf/).

- Drugs@FDA Glossary (https://www.accessdata.fda.gov/scripts/cder/daf/index. cfm?event=glossary.page).

- NDA Classification Codes (https://www.fda.gov/media/94381/download).

To view this issue and all back issues online, please visit www.drug-dev.com.

Dr. Josef Bossart serves as Managing Director at The Pharmanumbers Group. He has 4 decades of experience in the biopharmaceutical industry, having held senior sales, marketing, operations, and business development positions within Big Pharma and emerging Specialty Pharma companies. His activities include analyzing corporate, technology, and product development strategies in the area of Drug Delivery. Dr. Bossart earned his PhD in Medicinal Chemistry from The Ohio State University.

Total Page Views: 17469