Issue:October 2018

ANTIBODY DRUG CONJUGATES - Expansion of Approved Indications Backs 25% Increase in Global Market

INTRODUCTION

ADCs combine the extraordinary affinity and specificity of monoclonal antibodies with the anticancer potential of payloads. An ADC consists of a cytotoxin linked to a monoclonal antibody, which delivers the cytotoxic payload to specific cancer cells. Once inside the targeted cell, the cytotoxin is released to kill the cancer. Continuous efforts to improve the therapeutic potential of biologics and to develop novel efficacious drugs — either by modification or derivatization — led to the development of ADCs. BCC Research found that growth potential for the ADC market remains promising.

Although the design and synthesis of a fully functional and effective ADC is very challenging, there are now more than 50 ADCs in clinical trials. Anticipated revenues by 2021 reflect the expected approval of ADCs directed toward leukemia and ovarian cancer. With their advantages over conventional chemotherapies, which damage normal tissue, ADCs form a promising market. Technological advancements, the rising incidence of cancer, and an increasing demand for biologic therapies are all factors driving growth in the global ADC market.

Much of this growth is expected to result from additional approved indications for the two ADCs already on the market. These are Adcetris (brentuximab vedotin, marketed by Seattle Genetics Inc. and Takeda Pharmaceutical Co. Ltd.) and Kadcyla (ado-trastuzumab emtansine, marketed by Genentech Inc., a member of the Roche Group). Adcetris was approved in 2011 for relapsed Hodgkin lymphoma and relapsed anaplastic large-cell lymphoma, and Kadcyla was approved in 2013 for HER2 (human epidermal growth factor receptor 2)- expressing breast cancer. By 2021, ADCs for the treatment of breast cancer will represent a market share of 47.1%.

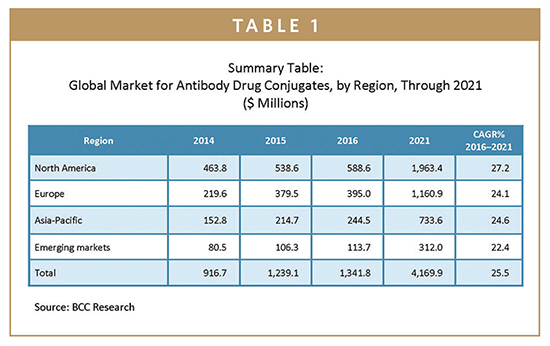

With just two approved drugs, the global ADC market was worth approximately $1.3 billion in 2016. At a 5-year compound annual growth rate (CAGR) of 25.5%, it is predicted to attain $4.2 billion by 2021. By region, North America is the largest market, valued at $588.6 million in 2016. North America is also the fastest-growing market and is forecast to total nearly $2 billion by 2021 at a CAGR of 27.2%. The ADC market in Europe, which reached $395 million in 2016, is expected to be worth close to $1.2 billion by 2021, reflecting a 5-year CAGR of 24.1%. Improving economic conditions, a demand for better healthcare facilities, and increasing R&D activities will support growth in the Asia-Pacific region (24.6%).

The market for ADCs is analyzed broadly according to the following categories: target antigen, payload, monoclonal antibody, linker, breast cancer, lymphoma, and other cancers.

TARGET ANTIGENS

Choice of the appropriate target antigen is a critical parameter that affects the efficacy, therapeutic window, and toxicity profile of ADCs. It is crucial that antigens have high selectivity for the tumor cell to limit toxicity and off-target effects. Based on antigen, the market for ADCs is evaluated according to the following targets: CD30, HER2, and other key antigens for ADC development that include CD19, CD22, CD25, CD33, CD56, CD74, and LIV1. The global market for ADCs targeting other such antigens is expected to reach $1.2 billion by 2021.

CD30, the target of Adcetris, is the characteristic marker of classical Hodgkin lymphoma, anaplastic large-cell lymphoma, and embryonal-cell carcinoma. Its restricted expression on normal cells makes CD30 an attractive candidate for targeted therapy. Adcetris is being evaluated broadly in more than 45 ongoing clinical trials. The global market for CD30-targeting ADCs is poised to reach $1 billion by 2021, increasing at a CAGR of 14.9%.

HER2 appears on the surface of some breast cancer cells and is also implicated in ovarian cancer. The increasing incidence of breast cancer is one of the major factors affecting growth of the market for HER2-targeting ADCs. Kadcyla, which targets the HER2 antigen, is being evaluated in seven Phase III clinical trials, as well as in earlier-stage trials. The market for HER2-targeting ADCs was valued at approximately $822.6 million in 2016.

PAYLOADS

A cytotoxin, often called a payload, is designed to induce target cell death when internalized and released. Based on mode of action, payloads fall into three categories: antimitotic, DNA interacting, and transcription inhibitors. Antimitotic payloads include maytansinoids and auristatins. DM1 and DM4 are the most widely used maytansinoids in ADC clinical trials. Monomethyl auristatin-E and monomethyl auristatin-F are important members of auristatins. Kadcyla and Adcetris both contain antimitotic payloads, DM1 and monomethyl auristatin-E, respectively.

Antimitotic and DNA interacting are the two classes of payloads that are most widely used to design ADCs. When stratified by payload, antimitotic is the leading segment in the global ADC market. DNA interacting payloads include calicheamicin, CC-1065 analogs, and duocarmycins. The segment for ADCs with DNA interacting payloads is expected to reach $983.7 million by 2021. Transcription-inhibiting agents include amatoxins, which are small bicyclic peptides that bind to RNA polymerase II and lead to cell apoptosis. Research is underway to understand the use of amatoxins as ADC payloads. Transcription-inhibiting payloads are still in the preclinical phase of development.

MONOCLONAL ANTIBODIES

A monoclonal antibody that is highly selective for a tumor-associated antigen with restricted or no expression on healthy cells is an essential component of an ADC. To maximize efficacy, the antibody should target a well-characterized antigen with high expression at the tumor site and low expression on normal tissue. Based on type of antibody, ADCs can be categorized into those containing a murine, chimeric, humanized, or human monoclonal antibody. Although early ADCs used murine monoclonal antibodies, their immunogenicity has restricted their use in ADC development. Murine monoclonal antibodies have been replaced with chimeric antibodies that have a human constant region and a murine variable region.

Kadcyla and Adcetris are both chimeric antibody-containing ADCs. Expected regulatory approvals for extended indications will further increase the sales of chimeric antibody-containing ADCs during the forecast period. This segment of the market could reach $1 billion by 2021 at a CAGR of 14.9%. However, most ADCs that are currently in use or in clinical development use either humanized or fully human antibodies. Humanized antibody-containing ADCs led the market in 2015 with $770.2 million in sales and are expected to grow at a CAGR of 30.6% through 2021. ADCs with human antibodies are still under development.

LINKERS

Linkers, which enable covalent attachment of the cytotoxic agent to the monoclonal antibody, play an important role in development of safe and effective ADCs. The majority of ADCs in clinical development use a limited number of chemical linkers. The mechanism of drug release is an important consideration in linker selection. Cleavable linkers are mostly cleaved from the payload in endosomes or lysosomal compartments via a variety of mechanisms, including acidic degradation, protease cleavage by cathepsin B, and thiol-disulfide exchange reactions. Conversely, noncleavable linkers require complete lysosomal proteolytic degradation of the antibody, generating a toxic payload with charged lysines or cysteines.

Based on type of linker, the market for ADCs is analyzed by those with cleavable or non-cleavable linkers. Kadcyla belongs to the non-cleavable and Adcetris to the cleavable linker category. Most of the ADCs in development have been designed using cleavable linkers. ADCs with cleavable linkers comprised approximately 62% of the global ADC market in 2015. ADCs with non-cleavable linkers had $519.2 million in 2016 sales. The market for ADCs with cleavable linkers is anticipated to grow at a CAGR of 30.6% from 2016 to 2021, while the segment of ADCs with non-cleavable linkers is expected to increase at a CAGR of only half that (14.9%).

BREAST CANCER

Breast cancer is the most common cancer in the world. According to the American Cancer Society, approximately 14% of breast cancers overexpress the HER2 protein. The discovery of the role of HER2 in breast cancer and consequent development of HER2-targeted therapies has dramatically improved clinical outcomes for women with both early stage and advanced HER2-positive breast cancer. Breast cancer held 61.3% of the global ADC market in 2016. With its one approved ADC (Kadcyla), breast cancer was the largest revenue-generating category by type of malignancy.

The efficacy of Kadcyla in treating metastatic disease is well recognized, and its use in early settings is anticipated. Its high efficacy and lack of side effects have made Kadcyla a successful therapy for HER2-positive breast cancer. Kadcyla is actively being evaluated in combination with other drugs to treat early stage and metastatic breast cancer. Apart from the further investigative studies of Kadcyla, there are several ADCs for breast cancer in development by other companies. The market for ADCs targeted against breast cancer was valued at $822.6 million in 2016 and is expected to grow at a CAGR of 19%.

LYMPHOMA

Lymphoma is the most common blood cancer. The two main forms are Hodgkin and non-Hodgkin lymphoma. The CD30 antigen, the target of Adcetris, is expressed by both these types of lymphoma. There are also other lymphomas that express the CD30 antigen on the surface of malignant cells. Adcetris, which is expected to undergo high double-digit growth, is going to be very effective in these histologic types, which are the subject of further investigations.

The market segment for lymphoma ADCs is expected to reach $1 billion by the end of 2021. Lymphoma held 38.7% of the global ADC market in 2016. The North American market for this category of ADCs is expected to grow at a CAGR of 18.2%. Projections are made on the basis of anticipated FDA approvals for Adcetris’ additional indications. The high incidence of non-Hodgkin lymphoma is another factor driving growth of the market. The European market accounted for $55.8 million in 2016 sales. ADCs to treatlymphoma in this geographic region are expected to increase at a CAGR 15.6% through 2021.

OTHER TYPES OF CANCER

ADCs to treat other malignancies such as ovarian cancer and acute myeloid leukemia are in various phases of development. All types of cancer except for breast cancer and lymphoma are aggregated in this segment. The global market for ADCs to treat these other cancers is expected to reach $1.2 billion by the end of 2021. Among geographies, North America is expected to account for the highest sales, which will mainly be driven by the expected FDA approval of several ADCs in the next few years.

ANALYSIS OF MARKET OPPORTUNITIES

Despite the high cost of ADCs, the market is growing steadily. There are myriad factors fueling the industry. For example, manufacturers of branded drugs dread patent expiration, which opens the door to low-cost generic versions that compete with their product. Once that profit is eroded by a generic, the company must make up for the loss of sales through a new or existing product. ADCs are considered attractive because, in most cases, they include an already-marketed drug. Moreover, the chemical complexity of an ADC makes its reproducibility a difficult task for generic manufacturers. In this manner, ADCs provide added patent and profit protection to manufacturers.

The targeted nature of ADCs has prompted the development of new forms of chemotherapeutics that are too potent to be used systemically, for example, maytansinoids. These compounds are highly potent, antimitotic agents. The cytotoxic agent maytansine was evaluated as a single agent in various types of tumors, but dose-limiting toxicities resulted in the discontinuation of all clinical trials. The conjugation of maytansinoids (specifically DM1 and DM4) to antibodies has significantly decreased the systemic toxicity reported in patients. Kadcyla is an example of an ADC that uses DM1.

Because of their specificity, biologics (especially monoclonal antibodies) have gained a lot of importance as a targeted therapy. The success of Kadcyla and Adcetris (and development of biologics in general) has given investors confidence in the field and encouraged researchers to focus on improving ADC designs. The number of ADCs in clinical development has increased from 33 in 2013 to roughly 60 at the end of 2016. Today, innovative ADC development continues as scientists work on stable linker technologies, more potent payloads, and better target selection.

Naturally, the upside of ADC development is accompanied by challenges. For one thing, ADC manufacturing facilities require high capital investment and extensive specialized training of operators, driving a trend toward the use of mostly contract manufacturers for ADCs. Only a few contract manufacturing organizations have the capability to perform all of the different steps required in the manufacture of ADCs. Thus, one key strategy is collaboration among contract manufacturers to create a one-stop shop for ADC developers.

Also, because developing an ADC is a complex process (which is considered a benefit in the context of generic competition), it makes them risky to produce and test. Careful patient selection is thus another requirement. To deliver the most clinical benefit, ADCs must be used with companion diagnostics to determine if a patient’s form of cancer has the target antigen for which the drug was designed. Targets must also be selected carefully to minimize off-target toxicities. Ultimately, challenges in ADC development are trumped by the vast rewards associated with their use for treatment of cancer, resulting in a remarkable market gain of $3 billion over the next 5 years.

This article is based on the following market analysis report published by BCC Research: Antibody Drug Conjugates: Technologies and Global Markets (PHM161B) by Shalini Shahani Dewan.

To view this issue and all back issues online, please visit www.drug-dev.com.

Laurie L. Sullivan, ELS, is a Boston-based writer and editor with 20 years of experience in medical communications. She is certified by the Board of Editors in the Life Sciences. She contributes regularly to the BCC Research blog focusing on Life Sciences.

Shalini S. Dewan earned her MS in Pharmaceutical Chemistry and has more than 14 years of industry experience. She was awarded a Gold Medal by the Prime Minister of India for her work and has worked with top companies in India and in the US. Some of her other reports for BCC Research include: Global Markets and Technologies for Advanced Drug Delivery Systems, Orthopedic Drugs, Implants and Devices and Global Markets for Reagents for Chromatography.

Total Page Views: 8565