2021 Analytical Testing eBook - Bioanalytical Testing is Fastest Growing Sector

The US pharmaceutical analytical testing outsourcing market size is expected to reach $5.55 billion by 20271, and $10.2 billion globally2, over the same period, driven by an increasing number of clinical trial registrations, innovations in the medical industry, and the entry of new players in the market. Moreover, increasing R&D investment, and growing demand for biopharmaceutical products are other factors responsible for the growth of the market.1

Additionally, the bioanalytical testing service segment is anticipated to witness the fastest growth, expected to reach a value of $4.56 billion by 2027.3 Development of biosimilars, combination molecules, and other innovative medicines have resulted in an increased demand for specific types of tests such as electrophoresis, electrochemical and titrimetric assays, and immunoassays.

Bioanalytical testing is used to quantitively determine properties of drugs and metabolites in biological matrices. This has several applications, including drug testing and assessment of bioavailability, bioequivalence, pharmacokinetics, and pharmacodynamics for drug development.

According to Grand View Research, the small molecule segment dominated the market for bioanalytical testing services and accounted for the largest revenue share of 55.6% in 2020.4

Most of the generic and branded drug compounds are of the small molecule category. Additionally, with the patent expiration of many blockbuster drugs, generic manufacturers are required to conduct and submit bioanalytical testing results. These factors primarily governed the growth of the small molecule drug bioanalytical testing market.

On the contrary, large molecule bioanalytical testing services are anticipated to exhibit healthy growth over the forecast period. This can be attributed to a rich pipeline of biologics or amino acid-based molecules. Moreover, testing these molecules requires technical know-how with advanced analytical instruments, the infrastructure for which is available with bioanalytical services providers. Hence, outsourcing bioanalytical testing of these molecules is likely to be the prevailing trend over the forecast duration.

Sample analysis dominated the market for bioanalytical testing services and accounted for the largest revenue share of 45.9% in 2020. Sample analysis helps determine the concentration of chemical elements or chemical compounds. Various techniques are used for sample analysis, varying from simple weighing techniques to advanced techniques by using specialized instruments.

Bioanalytical testing has been critical in the early detection of COVID-19. Owing to its applicability and high demand due to the pandemic, the bioanalytical testing outsourcing industry is expected to witness lucrative growth.

In this annual Drug Development & Delivery analytical ebook, we present best practices in stability studies as well as the benefits of UPLC optimization.

REFERENCES

1. U.S. Pharmaceutical Analytical Testing Outsourcing Market Size, Share & Trends Analysis Report by Service (Bioanalytical Testing, Method Development & Validation), by End-use, and Segment Forecasts, 2020-2027, ResearchandMarkets.com, Feb. 1, 2021.

2. Global Pharmaceutical Analytical Testing Outsourcing Market to Reach $10.2 Billion by 2027, Sept. 8, 2021.

3. Bioanalytical testing services market to become a $4.5 billion industry, European Pharmaceutical Review, Oct. 19, 2020.

4. Bioanalytical Testing Services Market Size, Share & Trends Analysis Report By Molecule Type (Small Molecule, Large Molecule), By Test Type (ADME, PK, PD, Bioavailability, Bioequivalence), By Workflow, By Region, And Segment Forecasts, 2021 – 2028, Feb. 2021. 301123672.html.

Benefits to Converting Old HPLC Methods to Optimized UPLC Methods

Benefits to Converting Old HPLC Methods to Optimized UPLC Methods

By: David Browning, Pharmaceutical Laboratory Director, IAL

When considering a switch from traditional High-Performance Liquid Chromatography (HPLC) to Ultra-High Performance Liquid Chromatography (UPLC), there are several important factors to consider, such as how frequently is the test performed, how many samples are tested, what is the existing method, and what are the costs associated with testing. The most important consideration to most companies is going to be the impact of the change. Because the UPLC operates on the same principles as HPLC, the impact on analysts is minimal. The software and equipment operation are slightly different between the two; however, most of the skill and expertise directly transfers from HPLC to UPLC. Also, the regulatory impact is minimal as the FDA allows for changes that are “equivalent to or better than” existing test procedures and fall into the category of annual reportable changes.

When should you consider switching from HPLC to UPLC? For any method developed in the 1980s or earlier (those with a 25-cm or 30-cm column, with a large particle size, and high flow rate), the decision is an easy one. An older method is typically problematic to run in a way to meet the current cGMP expectations for chromatographic methods. Separation tends to be poor, sensitivity is low, and run times are long. Any of those methods are good choices for updating. Currently, the USP has 10% to 15% of the LC methods using UPLC, and that is only going to increase in the future. As the FDA continues to demand lower Limit of Detection (LOD) and Limit of Quantitation (LOQ) for impurity tests, the need for better methods becomes essential for maintaining cGMP compliance.

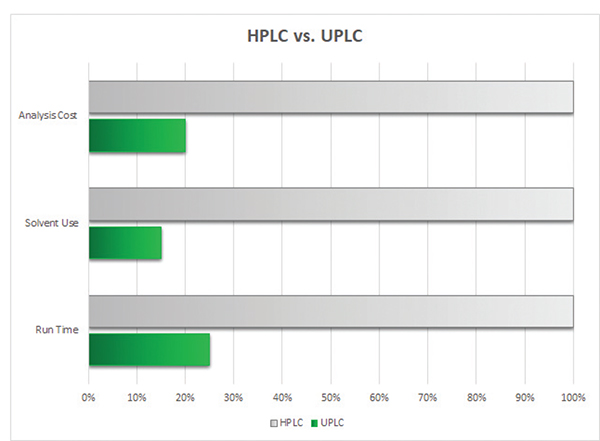

If the test is performed more than once a week or with sample testing exceeding 10 hours per week, then switching to a well optimized UPLC method is a good choice to consider for improving laboratory efficiency and reducing costs. Switching from a traditional HLPC method to UPLC can reduce solvent use by 50% to 75%. As solvent costs increase 5% to 10% annually, reducing solvent use directly benefits the bottom line for the laboratory.

By reducing solvent use, solvent waste is reduced by the same proportional amount. Reducing waste disposal costs and decreasing environmental impact is a win-win for the financial group and the public relations department. For large laboratories, three HPLCs can be replaced with a single UPLC.

This will increase available laboratory workspace, which is a premium at most companies. It will also reduce capital expense and maintenance expense for the laboratory. Reducing the department calibration expenses and equipment service costs also benefit the company.

For methods in which separation is important, UPLC provides sharper more symmetric peaks when compared to HPLC. UPLC uses smaller injection volumes, reducing peak asymmetry and baseline noise around the peaks. UPLC systems have significantly smaller dwell volumes allowing for faster gradient changes and less time wasted for each injection. The smaller tubing and shorter columns produce less peak broadening, resulting in better separation. These all contribute to better sensitivity, increased plate counts, and significantly better resolution.

All the advantages listed will result in faster turnaround times, higher lab productivity and reduced costs. So how do you decide when it is cost effective to switch to UPLC? You look at the time and cost of the methods you are running, and look at what changes provide the greatest improvement based on the information provided. Finally, ask for a quote for the cost of development and validation and compare it to your current laboratory expenses for performing the testing.

Ensuring Stability Excellence for Global Consumer & OTC Proucts

Ensuring Stability Excellence for Global Consumer & OTC Proucts

By: Ramesh Jagadeesan, PhD, Assistant Vice President, Analytical Development, Recipharm

Stability studies are defined as the extent to which a product retains its quality within specific limits and throughout its period of storage and use. For over-the-counter (OTC) and consumer healthcare products, this includes the expiration date and shelf life, storage requirements, and packaging requirements such as the impact of container closure systems.

Stability study programs form a fundamental part of the product development process, ensuring medicine that reaches the patient is both safe and effective. They are also a regulatory mandate as part of the life cycle of a treatment with the International Conference on Harmonisation (ICH Q1A) guidance designed to support companies in maintaining a rigorous approach to stability studies. Stability is a critical quality attribute (CQA) for pharmaceuticals to support the justification of process formulation, packaging, and storage condition changes.

These programs are conducted throughout the whole product life cycle from early-phase development through process development, scale-up, and commercialisation following final product approval. There are several types of stability studies that are used to demonstrate efficacy and safety and determine how products should be stored and transported, and for how long.

These include:

- Real Time or Room Temperature (RT) – also known as long-term stability studies. These are experiments conducted on the physical, chemical, biological, and microbiological characteristics of a drug during and beyond the expected shelf life and storage periods to monitor for degradation or changes to the drug in question.

- Accelerated – these studies are designed to increase the rate of chemical degradation and physical change of a drug by using exaggerated storage conditions. The main aim is to determine the stability profile and predict shelf life.

- Intermediate – these studies are designed to moderately increase the rate of chemical degradation or physical change.

- Freeze/Thaw – freeze/thaw cycle testing is designed to put samples through a series of extreme, rapid temperature changes that could occur in transit or storage and monitor the impact on the formula. Typical studies include storage of product at extremely low and high temperatures, such as -20°C and 50°C for a duration of up to 12 days in multiple cycles, depending upon the proposed route, time, and length of travel.

- Photostability Study – these studies include forced degradation testing and confirmatory testing and are designed to evaluate the overall photosensitivity of the material for method development purposes. Samples should be exposed to light providing illumination of no less than 1.2 million lux hours and an integrated near ultraviolet energy of not less than 200 watt hours/square meters.

- Bulk Hold Stability Study – bulk hold studies are conducted on pilot-scale batches to demonstrate comparable stability to the dosage form in the approved packaging.

- Period After Opening (PAO) Stability Study – these studies are designed to determine how long after the primary packaging is opened a product remains suitable for use.

- Static Thermal/Humidity Stress Studies – stressing at 50°C or 60°C for five weeks.

- Shipping Studies – length of study should be sufficient to cover storage, shipment, and subsequent use.

In addition to the ICH guidelines, which vary based on the climatic zone of the intended market, there are also several other governing bodies, including the World Health Organization (WHO), the Association of South-East Asian Nations (ASEAN) group, the Cooperation Council for the Arab State of the Gulf, as well as several regional/country-specific guidance documents provided by the EMA, FDA, ANVISA, and USP. These different requirements all make stability studies a complex landscape to navigate without access to the required expertise and capacities. Additionally, different formulations require different types of testing. For example, parenterals require additional tests to monitor sterility, particulate matter, and pyrogenicity.

In order to run successful stability programs, companies need access to significant and flexible resources and storage space and have detailed planning and logistics in place that can be adapted to meet changing requirements. They also need access to the required expertise in study design, in regulatory and quality requirements, and in analytical chemistry and validated stability chambers under ICH conditions with continuous maintenance, monitoring, and security. In addition, capacity in analytical laboratories, not filled up with quality control and release priorities, is also essential. These requirements all mean that outsourcing stability programs can be the best option.

Selecting a partner with a wealth of experience and with laboratory capacity allows companies to ensure stability study success and allow their internal resource to focus on core development activities.

Find out more about how Recipharm can help you: https://www.recipharm.com/media/stability-studies.

Total Page Views: 3933