HCV MARKET - Recent Success in HCV Treatment Brings Relief to Patients but Challenges to Companies

INTRODUCTION

Driven by several novel regimens recently receiving approval in the US and in Europe, high cure rates exceeding 90% are now achievable for most patients suffering from chronic hepatitis C. As a result of this unprecedented success, the industry is reaching a new phase in the fight against this deadly infectious disease. The pressure is now shifting to the healthcare providers to determine if the future of hepatitis C treatment will include a (near) eradication in the developed world, or if hepatitis C will remain a debilitating and life-threatening factor in our society.

HEPATITIS C TREATMENT LANDSCAPE

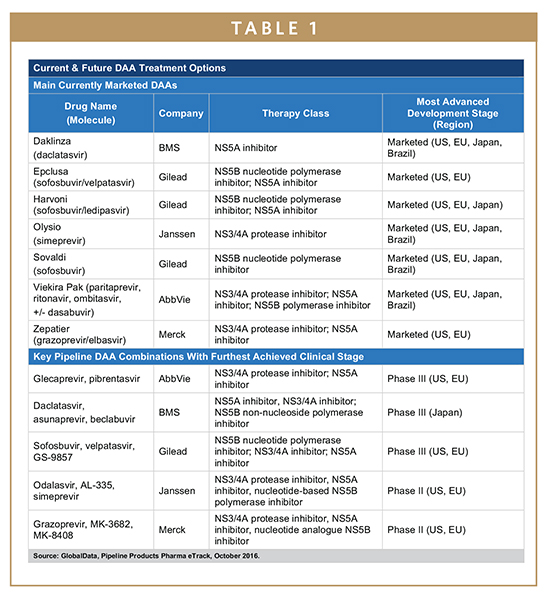

The treatment of chronic infections caused by the hepatitis C virus (HCV) has undergone a dynamic shift in recent years. Historically, treatments were based on interferon, which was subsequently replaced by peginterferon, administered in combination with ribavirin. Although these treatments were able to achieve cure rates of over 50% in some patient groups, they were also associated with severe adverse events (AEs) and long treatment durations of nearly a year under close supervision by a physician. The development of the first direct-acting antiviral (DAA) ushered in a new era, in most cases reducing the severity and frequency of AEs, shortening and simplifying treatments, while simultaneously increasing efficacy. The first-generation DAAs included Vertex’s Incivek (telaprevir) and Merck’s Victrelis (boceprevir), both NS3/4A inhibitors, which launched in the US for genotype 1 (GT1) patients in 2011. However, the main breakthrough came in 2013 with the approval of the first NS5B inhibitor, Gilead’s Sovaldi (sofosbuvir). Gilead followed up on the success it achieved with Sovaldi with the launch of Harvoni (a fixed-dose combination of sofosbuvir and ledipasvir, an NS5A inhibitor). The ability to cure over 95% of many patient populations, simultaneously shortening treatment durations to 12 weeks with a once-daily single pill, while also eliminating peginterferon and ribavirin for most patients, truly revolutionized the hepatitis C treatment paradigm.

Together, Sovaldi and Harvoni helped to position Gilead as the unquestionable market leader in the 9 major markets (9MM: US, France, Germany, Italy, Spain, UK, Japan, China, and Brazil), providing the pharmaceutical giant with global revenues of $19.1 billion in 2015 alone. However, other companies did not remain on the sidelines. Bristol-Myers Squibb (BMS) is currently represented in all major markets, with Daklinza (daclatasvir) in the US and Europe as well as with Daklinza and Sunvepra (asunaprevir) in Japan, BMS’ most important market. Janssen, the pharmaceutical arm of Johnson & Johnson, is currently represented by Olysio (simeprevir). Despite having efficacious products in these markets, both BMS and Janssen have struggled for market share against Gilead in the past 2 years, mostly due to the fact that the two main recommendations used by physicians globally, AASLD and EASL, include Olysio and Daklinza only in combination with Sovaldi or with Sovaldi and ribavirin, thereby opening the door for Gilead to use differential pricing of Sovaldi and Harvoni. By providing Harvoni at a 12.5% list price premium over Sovaldi, Gilead has as much as eliminated the margin for other market participants relying on co-administration with Sovaldi, making Harvoni the drug of choice for the important GT1 patient group.

Additional competition has also come from AbbVie and Merck. Both companies provide a Sovaldi-independent DAA regimen for patients infected with either GT1 or GT4. Although AbbVie’s Viekira Pak (paritaprevir, ritonavir, ombitasvir, +/- dasabuvir) was already approved in 2014, it struggled to gain market share as the drug required different treatment approaches for the different GT1 subgroups, GT1a and GT1b, and required a twice-daily administration of multiple pills, compared to Harvoni’s single-tablet, once-daily administration. AbbVie’s hope for that to change in the next months will be based on the recent FDA approval for a once-daily formulation, Viekira XR. On the other hand, Merck has rebounded from the failure of Victrelis, launching its new DAA regimen Zepatier (grazoprevir/elbasvir) successfully this year in the US and in Europe, and Zepatier is now poised to be one of the major DAA regimens for patients with GT1 and GT4 during the next years. Despite these various attempts to break Gilead’s dominance during the past 2 years, these multi-faceted disadvantages for Daklinza, Olysio, and Viekira Pak have resulted in a lopsided situation in which Gilead’s competitors achieved a combined market share in the US of about 10% in 2015, although Merck’s Zepatier might the first non-Gilead DAA reaching double-digit market share in the coming years.

Despite this success of the pharmaceutical industry in addressing the major unmet needs in the HCV field, not all patient groups profited equally from these advances. The initial focus of the industry was on DAA regimens curing patients infected with GT1, the most prevalent GT in the 9MM. Until this year, GT2 and GT3 patients proved more problematic to treat, and cure rates lagged behind those of GT1 patients. In addition, several other patient groups were still waiting for their medical needs to be met, including patients with comorbidities like kidney or renal failure, patients co-infected with HIV and/or hepatitis B, and patients relying on other medication with significant drug-drug-interactions (DDIs) with the DAAs.

CHANGES IN THE DAA TREATMENT LANDSCAPE

Fortunately, 2016 has ushered in a new phase in the treatment of hepatitis C. The launch of Gilead’s Epclusa (sofosbuvir/velpatasvir) in July 2016 in the US was only the first in a row of pan-genotypic treatment alternatives. These new DAAs are not only expected to be recommended for all GTs, eliminating some of the treatment complexity, but also to provide significantly improved outcomes for patients currently considered as difficult to treat. In particular, patients with GT3, the second most prevalent GT in many European countries and third most prevalent in the US, will see significant improvements in their treatment outcomes as sustained viral response (SVR) rates are expected to reach similar levels as for GT1. Furthermore, the availability of multiple pan-genotypic combinations launching in the next few years can increase the number of treatment algorithms to avoid DDIs.

However, given the strong clinical profiles of current and future DAA regimens, companies need to develop alternative approaches to distinguish their brands from the competition. Although price is an important factor in this equation (see below), cost will not be the only determining factor in market success in the future, as companies will have strong incentives to keep the overall prices high for the next decade. An appealing approach chosen by several drug developers is the attempt to shorten treatment durations. The time required for curing patients of chronic HCV has already been reduced from nearly 1 year about a decade ago to 12 to 24 weeks today, depending on the patient’s GT and liver status. Harvoni already demonstrated high efficacy after 8 weeks of treatment in patients with GT1 and no cirrhosis, and both Gilead and Janssen are currently developing possible pan-genotypic DAAs that might be able to cure the same patient population after only 6 weeks of treatment.

Further possibilities in increasing market share in the future will lie in a further simplification of the treatment algorithm, for example by leveraging pan-genotypic treatments, improved efficacy outcomes for difficult-to-treat patients, and further improvements in safety/tolerability. Consequently, several clinical trials are currently assessing the efficacy of various DAAs in patients with severe comorbidities, including kidney and renal failure. Another possibly successful path for increased market penetration of a newly launching DAA is the complete elimination of ribavirin for patients with decompensated liver cirrhosis, a drug with possibly severe AEs.

FINANCIAL BURDEN OF TREATMENTS

Despite the clinical success of DAAs, the manufacturers are under heavy scrutiny by the public and politicians for the pricing policies of these life-saving treatments. However, while Sovaldi’s wholesale acquisition cost (WAC) is listed for $84,000 and Harvoni’s at $94,500 for a 12-week treatment, the average revenue per treatment reported by Gilead in 2015, including both 12- and 24-week-long treatments, was estimated to be around $54,000 and during the first 6 months of 2016 the price per treatment dropped another 22% — a possible response to the launch of Merck’s Zepatier in January of 2016, listed at $54,000 per treatment. Clearly, most insurers in the US were able to obtain significant discounts for Gilead’s HCV drugs, and corresponding price discounts are estimated for DAAs from other companies. Although the list price can exceed $1,000 per single pill, seen in context, the price is not necessarily high, as some cancer drugs can be priced beyond tenfold higher for a life-saving treatment algorithm. Furthermore, the simplicity of current HCV treatments, with a single pill taken once daily, absent of peginterferon injections or even stays in the hospital, might have contributed to the perception of HCV drugs being overpriced.

Nevertheless, despite these steep discounts, and the overall cost-effectiveness of many DAA algorithms, the treatment of hepatitis C represents a significant cost burden for most healthcare systems. Total sales for DAAs reached $22.7 billion in the 9MM in 2015, driven by the large number of patients requiring treatment, as the prevalence rate of HCV exceeds 1% of the overall population in several countries of the 9MM. As a response, many private insurances and nationalized healthcare providers have limited access to these drugs to rein in the overall cost of hepatitis C treatments, in particular for individuals not suffering from liver cirrhosis. However, several factors are driving the market toward more inclusive national treatment approaches. In the past 3 years alone, over 1 million people have been treated with Sovaldi-based regimens. Since most of these people will have been cleared of the virus, the total prevalence in most of the 9MM is now slowly decreasing. With fewer patients seeking treatment, healthcare providers can expand the medical criteria for treatment initiation, for example from cirrhotic patients to patients with F3 or F4 fibrotic liver statuses. Other countries use an alternative approach. For example, France recently announced that, starting September of 2016, every patient with HCV will be permitted to receive reimbursed DAA treatment. However, the country also limits the annual expenditure at €0.7 billion per year, effectively allowing only less than 10% of the total prevalent cases to be treated in 2017. Simultaneously, countries also demand DAA manufacturers to cover the patient’s treatment costs if the virus is not cleared after the completed treatment algorithm, an approach that, if successful, could also be implemented outside the HCV field.

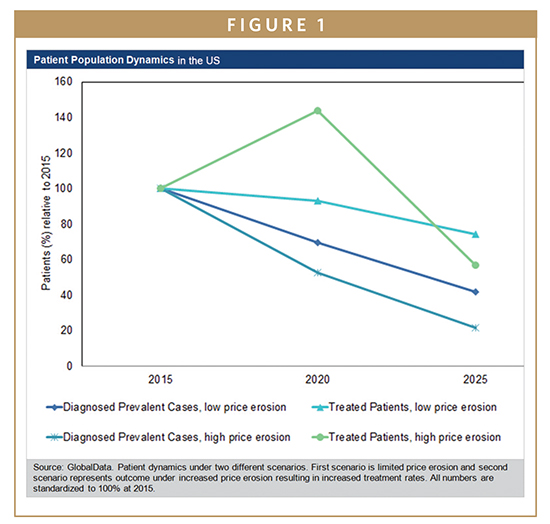

With newly launching pan-genotypic drugs, the competitive landscape in the 9MM will further diversify and intensify in the upcoming years. The price erosion experienced during the past 2 years, however, is unlikely to continue, as overall HCV market dynamics are inclined against significant price reductions in the next years. Each of the five pharmaceutical giants with a pipeline product expected to launch during the next years already has a marketed product in most of the 9MM. Therefore, newly launching pan-genotypic drugs will likely be priced at a premium relative to existing DAAs. Furthermore, none of the currently marketed DAAs will lose patent protection during the next decade, preventing price erosion driven by the launch of generic products. However, the main reason for price stability can be found in the disease prevalence itself. Given the already high treatment rates in many countries, combined with low incidence rates and remarkably high SVR rates achieved by current DAA treatments, the patient population seeking treatment is decreasing. Particularly in the countries in which the pharmaceutical industry experiences the highest revenues, the US and Japan, the decline in diagnosed prevalent cases of chronic hepatitis C threatens the sustainability of future HCV drug revenues. Should the price erosion continue at a similar pace, the revenue stream could dry up many years prior to patent expiration. Another example of limited price erosion in the next year can be expected in France with an annual cap of €0.7 billion per year. Here, the country pre-defined the market size, and price erosion would translate into more patients being treated by each company’s DAA regimen without translating into higher revenues.

GLOBAL OUTLOOK

The treatment of chronic HCV has undergone a seismic shift during the past few years and HCV can now be considered a curable disease in most patient populations. This success story also translates into higher barriers for companies, as intense competition limits market access while simultaneously the population pool targeted by these drugs is expected to decline in the next decade.

Despite the clinical success, several unmet needs remain in the market, with the overall cost burden of DAA treatments representing the biggest issues for the next years. Nevertheless, should governments initiate aggressive screenings to identify patients with HCV who have not been diagnosed in the past, in combination with broad application of DAA treatments even for non-cirrhotic patients, the overall burden of the disease could quickly fade. Although complete eradication across the 9MM during the next decade will be near impossible, a large initial investment into diagnostic screenings and treatment could translate into significant health-cost savings in the succeeding years, as declining prevalent cases not only result in fewer patients seeking treatment in the future but also lower the number of new infections and reduce associated healthcare costs related to liver cirrhosis, liver transplants, kidney failure, or liver cancer. As an alternative, healthcare providers might just wait on such an initiative until the launch of highly efficacious generic DAAs.

For more information on this and other related reports, please visit www.globaldata.com.

To view this issue and all back issues online, please visit www.drug-dev.com.

Mirco Junker, PhD, is an Analyst covering Infectious Diseases at research and consulting firm GlobalData. He extensively researches and provides in-depth analysis on a wide range of topics in the infectious diseases space, including hepatitis C therapeutics and vaccine research, development, and immunization policy.

Mirco Junker, PhD, is an Analyst covering Infectious Diseases at research and consulting firm GlobalData. He extensively researches and provides in-depth analysis on a wide range of topics in the infectious diseases space, including hepatitis C therapeutics and vaccine research, development, and immunization policy.

Total Page Views: 7915