Issue:April 2018

CLINICAL TRIALS - Inconsistencies Prevalent in Study Start-Up

INTRODUCTION

As stakeholders are increasingly aware that better study startup (encompassing the activities associated with site identification, feasibility assessment, selection, and activation) processes are linked to shorter clinical timelines, the emphasis has been shifting in that direction.1,2

In a recently completed comprehensive study, The Start-Up Time and Readiness Tracking (START) II, 2017 conducted by Tufts Center for the Study of Drug Development (CSDD), a significant difference in cycle times between new versus repeat sites and organizations [sponsors versus contract research organizations (CRO)] was observed; however, the percentage of sites never activated remained at 11%, a figure that has not changed substantially in over a decade.1 The primary reason cited was budgeting and contracting problems, which has been a challenge identified in much published work.3 Given the new technology solutions and practices, as well as the increasing number of dedicated personnel managing site relationships, it’s surprising and disappointing that the industry has not been about to make any headway in reducing the number of non-active, non-enrolling (NANE) sites.

Given the plethora of new approaches and solutions now being deployed to improve the study start-up process, the Tufts CSDD research provides a baseline upon which future studies can be conducted to gauge progress. The study was funded by an unrestricted grant from goBalto, a technology solutions provider.

The research examined a number of areas associated with study start-up, including site identification, study feasibility and recruitment planning, criteria for site selection, staffing and resources, and study start-up process improvements and opportunities.

The respondents were composed of 403 unique organizations and three-quarters were US-based. More than half of respondents worked in sponsor companies 53% or CROs 24%, with additional responses from sites, medical device companies, and academic institutions.

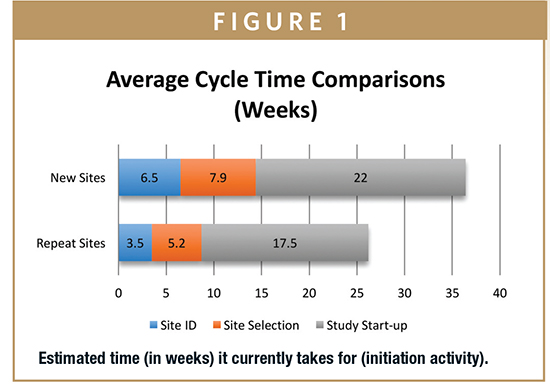

Site identification cycle time was defined as the time taken to identify appropriate investigative sites. Site selection cycle time was defined as the time from site identification to feasibility and receipt of site qualification information to final site selection decision. Study start-up (also referred to as site readiness and site activation) cycle time was measured as the time that all initial sites (ie, non-backup or contingency sites) are activated or from the time the site selection decision is made until all sites are initiated and ready to enroll.

The research found that cycle times were shorter for repeat sites than they were for new sites (Figure 1). Clinical operations teams typically rely on relationships with principal investigators built over time, and while the idea of using all repeat sites might seem like a logical and sure-win way to speed study start-up it is important to point out that research suggests for a typical multi- center study, 30% of sites selected are new, of which 13% are completely new to clinical research. Institutional knowledge about sites is frequently dated and soiled within departments and may not be relevant to the therapeutic area under investigation, for example, rare and orphan disease trials often require companies to work with sites and investigators they have not interacted with in the past. Moreover, study teams are blinded to problems inherent with this approach –namely, it limits opportunities to engage with new sites that could be more effective than those familiar to the study team.4

According to the research, companies do not use one single source of data to identify sites; a mix of non-evidence-based approaches are used, including personal networks, proprietary databases, and recommendations from study teams. Although clinical research professionals recently have been seeking access to accurate site-level performance metrics to aid investigative site identification. Use of site-level data to predict enrollment may be a more attractive option for increasing the pool of evidence available to support study start-up decision-making.5,6

CONSISTENCY MATTERS

If you fail to plan, you are planning to fail. These words ring true when it comes to study start-up, especially as the clinical trials sector embraces planning as key to boosting study quality. Planning works by getting it right from the beginning — prior to study activation — requiring sponsors and CROs to identify what is needed upfront to reduce risk. So, what attributes make some organizations more consistent that others in adherence to timelines and budgets?

Only 32% of respondents were found to have consistent cycle times across all study start-up activities, completing site activation about 7 weeks earlier than other companies when working with both new and repeat investigative sites. Interestingly, respondents in the most consistent group were more likely to work with sites that are new to the organization and reported a lower percentage of non-activated sites compared to their counterparts. The most consistent groups are investing more in technology, especially in site identification, suggesting they spend greater resources on finding the right sites and they tend to be smaller companies.

SPONSORS VERSUS CROS

Outsourcing has become the popular way for pharmaceutical companies to utilize on-demand services, improving operational efficiencies and therapeutic expertise and adding extensive geographic capabilities. This reflects a sharper focus on core competencies and a shift to allow CROs to manage and conduct clinical trials.

More than just a fad, this trend is nothing less than a paradigm shift in the pharmaceutical industry that has struggled to contain costs and timelines associated with trials as the rescue study services industry has boomed.7 But are CROs more efficient at study start-up?

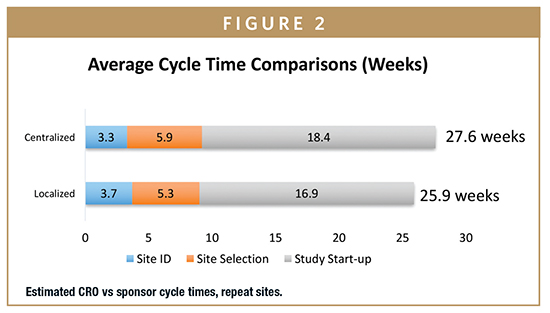

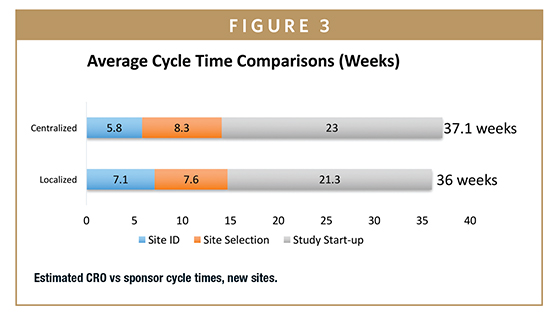

The greatest differences were observed between sponsor and CRO practices. Cycle times reported by CROs — in comparison with those reported by sponsors — were significantly shorter: site initiation cycle times were 5.6 weeks shorter (20%) for repeat sites and 11 weeks shorter (28%) for new sites (Figures 2 and 3). Overall, CROs report completing all site related activities 6 to 11 weeks faster than sponsors.

These external service providers can achieve economies of scale unavailable to sponsors when they combine the volumes of multiple companies. Although the differences were not statistically significant, the research found that on average, CROs dedicate 18 FTEs to site selection and 30 to activation, compared with an average of 12 and 13, respectively, for sponsors. CROs also report a lower level of site non-activation at 8.7%. One potential explanation for these results is that sponsors are relying more on CROs to manage site activity, and CROs have been able to invest in more processes that would create efficiencies.

ACCELERATING PROCESSES

The status of clinical trials continues to stymie industry stakeholders anxious to rein in the cost of product development and adhere to tighter timelines. Despite intense pressure to speed development, mounting evidence documents ongoing inefficiencies tied to complicated protocols, globalization, and old-school paper-based processes, driving clinical stakeholders to embrace technologies that are finally moving the needle.

But this opportunity is not without its challenges. Conducting clinical trials in places with unfamiliar regulatory pathways, cultural differences, and limited infrastructure is highlighting the value of technology that streamlines bottlenecks allowing stakeholders to better adhere to established timelines and budgets. In the on-going pursue of cycle time reductions, what attributes are associated with the fastest companies?

The research shows that the fastest groups reach site activation (on average) in less than half the time of other companies when working with new or repeat sites. When working with repeat sites, they achieve site identification and selection 2 to 3 weeks faster, and site activation up to nearly 12 weeks faster than their counterparts. The time savings are even greater when working with new sites. Regardless of organization, centralized groups have longer cycle times; however, the differences are not statistically significant. There is no real significant difference in terms of the mix of sites (new versus repeat) that the fastest companies use compared to their counterparts.

The fastest groups are investing less in technology, suggesting they may have already achieved some cycle time advantages based on prior technology investments; nevertheless, they rely more on technology or more sophisticated tools to manage their processes than their counterparts and indicate that they are more satisfied with their current tools/technologies (reinforcing that they may be benefitting from prior investments in this area). Not surprisingly, the fastest companies tend to be smaller companies and CROs.

ORGANIZATIONAL STRUCTURE: CENTRALIZED VERSUS LOCALIZED

Study start-up is very complex and a recognized bottleneck whose functions are performed by multiple people in multiple locations at the sponsor, CRO, and site levels, all of whom need to communicate and share data. To make this happen, dedicated systems integrated with other clinical trial technologies is essential, but what about the organizational structure of clinical operations teams? Do centralized groups outperform non-dedicated groups?

According to the research, centralized functional groups report slightly higher satisfaction with their processes, reporting larger time savings, and appear to adopt technology more, whereas decentralized or localized functional groups report slightly better cycle times with new (3% faster) and repeat (6.2% faster) sites.

Irrespective of organizational structure, both groups face similar challenges and see the same opportunities for improvement. There is no conclusive evidence that centralizing the function of site identification through to site activation achieves significant improvements.

TECHNOLOGY & PROCESS IMPROVEMENTS

Many of the improvement areas cited involve new technologies or changes in organizational processes and require a great investment of resources and time. Despite many attempts at improvement within organizations, gains in end-to-end cycle time have not been made.

Practices intended to streamline study start-up timelines include the use of technology investments to expedite the collection of clinical data and to help sponsors/CROs better monitor clinical trial performance. New technologies include predictive analytics and site forecasting for investigator identification, automated online site feasibility and site scoring system for faster turnaround time, and electronic document exchange repositories to speed up essential document collection.8 Many sponsors and CROs have also implemented clinical trial management systems (CTMS), electronic cloud-based solutions and online clinical document exchange portals.9 Shared investigator databases are another resource that organizations are utilizing.

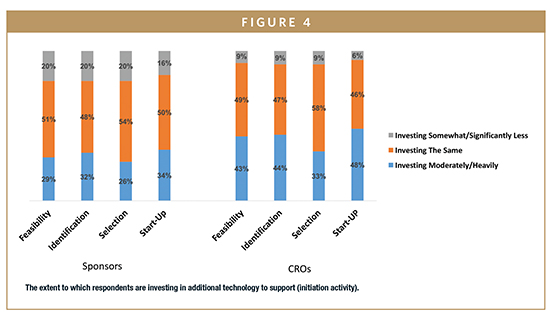

CRO and sponsor subgroups also differ in technology investment. On average, those working at CROs are investing about 10% more frequently in all areas of study initiation (identification, feasibility, selection, and study start-up [ie, activation)] and more frequently invest moderately to heavily across all areas when compared with sponsors (Figure 4).

According to the research, 80% of respondents who have invested in technology report time savings. Respondents reporting their technology is adequate have 30% shorter cycle times than those with inadequate technologies.

On average, 10% of respondents reported they are very satisfied with their study start-up processes, whereas 30% to 40% expressed dissatisfaction. Respondents reporting that they are very satisfied have cycle times 75.5% shorter than those reporting they are completely unsatisfied. Overall, nearly 40% of respondents of respondents are still using unsophisticated methods (eg, excel, paper-based systems), which may contribute to lower satisfaction levels.

Respondents were largely aligned on what measures would be most effective at enhancing various study start-up activities. The top cited option for enhancing site identification was “pooling and sharing data on site performance” with 88.9% of respondents indicating it would enhance the process, for site selection, the top cited option was to “get better evidence of a site’s true potential before selection” at 95.7%, and for activation process enhancements “central IRB/Ethics approval process” at 94.5%.

This research presents new benchmark metrics on the comprehensive cycle time from site identification through site activation. Overall, the study start-up process is still very long — 5 to 6 months total duration on average — a figure that has not improved throughout the past decade.

There is still a pervasive need for effective solutions across the industry despite many commercially available options (IMS Study and Site Optimizer, TransCelerate Shared Investigator Platform, and Investigator Databank) and internal solutions (eg, internal investigator dashboards and site feasibility software).10

There is wide variation and inconsistency in study start-up practices within and between sponsor companies.11 Given the high cost of initiating one site, which has been estimated at $20,000 to $30,000 plus another $1,500 per month to maintain site oversight, the prevalence of delays, and inefficiencies associated with study start-up activity, sponsor and CROs are continually looking to improve their study start-up cycle times.

The full report, subsequent mini-reports, as well as the groundbreaking START research conducted in 2012, are available for download from the goBalto Resource Center (https://www.gobalto.com/resource-center).

REFERENCES

1. CTTI recommendations: efficient and effective clinical trial recruitment planning. https://www.ctti-clinicaltrials.org/projects/recruitment. Accessed November 29, 2017.

2. Abbott, D, Califf, R, Morrison, B. Cycle time metrics for multisite clinical trials in the United States. Therapeutic Innovation & Regulatory Science. 2013;47:152–160. http://journals.sagepub.com/doi/abs/10.1177/2168479012464371.

3. Financial and operating benchmarks for investigative sites: 2016 CenterWatch-ACRP collaborative survey. https://www.acrpnet.org/resources/financial-operating-benchmarks-investigative-sites. Accessed August 24, 2017.

4. Morgan, C Removing the Blinders in Site Selection. Advance Healthcare Network. August 3, 2016 http://health-information.advanceweb.com/Features/Articles/Removing-the-Blinders-in-Site-Selection-2.aspx.

5. Sears, C, Cascade, E. Using public and private data for clinical operations. Appl Clin Trials. 2017;25:22–26. http://www.appliedclinicaltrialsonline.com/using-publicand– private-data-clinops.

6. Sullivan, L. Defining “quality that matters” in clinical trial study start up activities. Monitor. 2011;25:22–26.

7. Research and Markets: The New 2015 Trends of Global Development Outsourcing Market. Business Wire. January 30, 2015. http://www.businesswire.com/news/home/20150130005621/en/Research-Markets–2015-Trends-Global-Clinical-Development#.Vh50c-xVhHx.

8. Lamberti, M, Brothers, C, Manak, D, Getz, KA. Benchmarking the study initiation process. Therapeutic Innovation & Regulatory Science. 2013;47:101-109. http://journals.sagepub.com/doi/10.1177/2168479012469947.

9. Morgan, C. The need for speed in clinical study start up. Clinical Leader. http://www.clinicalleader.com/doc/the-need-for-speed-in-study-startup-0001. Accessed

August 27, 2017.

10. Sears, C, Cascade, E. Using public and private data for clinical operations. Appl Clin Trials. 2017;25:22–26.

11. Schimanksi, C, Kieronski, M. Streamline and improve study start-up. Appl Clin Trials. 2013;22:22–27.

To view this issue and all back issues online, please visit www.drug-dev.com.

Craig Morgan is a technology and life sciences management professional with more than 15 years of experience in the application of informatics and bioinformatics to drug discovery. He currently heads up the Marketing and Brand Development functions at goBalto, working with sponsors, CROs, and sites to reduce cycle times and improve collaboration and oversight in clinical trials.

Total Page Views: 9517