Issue:January/February 2016

ADVANCED DELIVERY DEVICES - How Data Hubs & Smart Devices Are Enabling the Rise of Therapeutic Ecosystems

INTRODUCTION

It seems everyone is getting into digital health. As just a few recent examples, Philips has teamed up with Amazon, Sanofi with Google, JNJ with IBM, and Medtronic with Apple. In each case, there has been one common goal – to sync drugs, devices, and data to better monitor patient health. These collaborations between tech and biotech reflect a new paradigm in how therapeutics are being commercialized and marketed under the new pay-for-performance healthcare model. Industry participants that ignore these converging trends risk being left behind as innovators leverage smart technologies to create therapeutic ecosystems that create long-term, value-driven relationships with patients, prescribers, and payers.

CHANGING TIMES

You’ve probably heard about a “war on drug pricing” where the battle lines have been clearly drawn. On the one side, politicians and payers are demanding lower costs and regimented pricing controls. On the other side, patients and prescribers are seeking widespread access to the most effective treatments with maximum reimbursement. In the middle are the pharmaceutical companies, who are seeking to advance patient care whilst delivering an attractive return on their R&D investment.

Although this might be a simplistic view of things, it gets to the heart of a debate surrounding how much drugs should cost and who should pay for them. While drug pricing, reimbursement rates, and market share will always be determined by competitive market dynamics, the factors being used by healthcare stakeholders to make financial decisions are changing.

Traditionally, a volume-based model has been used to balance the upfront price of a drug against the number of units purchased. However, this model is being gradually replaced by a value-based model in which the upfront drug pricing must be balanced against the long-term socio-economic outcomes it can generate amongst patients, prescribers, and payers.

In particular, payers and large healthcare providers are investing heavily in systems that enable them to better understand the comparative value of the different therapeutic options available. Many have established dedicated research units that mine data from various sources, such as health claims, medical records, social media, and real-world patient preference studies. Increasingly, this information is being used by healthcare providers to allow its members to only access a single, preferred brand of therapy.

In one of the most recent examples, CVS Health selected Amgen’s Repatha® as the only PCSK9-inhibitor on its commercial formularies, in a move designed “to get the best price possible for clients and preserve our commitment to deliver the best care available.” In its press release, Amgen described the arrangement as a “value-based partnership.”

DEFINING VALUE

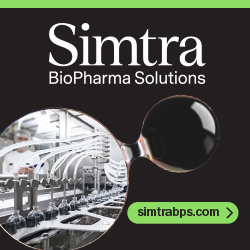

But how can a pharmaceutical company best showcase the competitive value of their therapies, particularly when there is limited pharmacological or pricing differentiation between competing brands? Pharmaceutical companies are increasingly utilizing an array of innovative technologies and practices to demonstrate how a therapy can save time, money, or lives.

By reducing steps of use or the number of pieces of equipment required, a therapy can eliminate complexity and reduce preparation time. By reducing frequency of administration, for example, from once a week to once every month, a therapy can minimize lifestyle disruption and potentially reduce the number of prescriptions to be filled. By shifting the place of administration from the clinic to the home, a therapy can reduce the burden on healthcare facilities and improve patient quality of life. By minimizing the pain or discomfort of administration, or providing medication reminders, a therapy may boost adherence rates and plug value leakages across the healthcare system. And by leveraging technologies, such as smartphones, Bluetooth, and data hubs, a therapy can efficiently bring patients and prescribers closer together to enhance the provision of care.

Such outcomes represent attractive value propositions that can be leveraged by pharmaceutical companies to optimize therapy pricing, maximize brand differentiation, and build or protect market share. As one health executive recently stated in a PWC report, “Tomorrow, drugmakers may not get paid for the molecule…they may only get paid for the outcome.”

In one clear recent demonstration of a value-based drug strategy, Gilead Sciences successfully justified the cost of Harvoni® and Solvadi®, which cure the vast majority of people with the most common type of hepatitis C within 3 months, based upon the long-term savings the products are projected to generate compared to the future treatment of acute liver disease. However, for most drugs targeting chronic diseases, the determination of a drug’s true value can be less black-and-white and more difficult to quantify using conventional processes.

Consider as one hypothetical that a new oncology drug is approved tomorrow. It comes in a convenient injectable formulation that enables intuitive once-monthly subcutaneous administration outside of the clinic. What proportional increase in price could such a product support compared to equivalent rivals that alternatively require slow IV infusion, and incur thousands of dollars in add-on costs relating to specialty care facilities, staff, and equipment?

Alternatively, consider auto-immune diseases, in which it’s common that half of a patient population does not maintain compliance with prescribed therapy regimens. It’s estimated that up to $300 billion is wasted every year in the US alone through patient non-compliance, with prime examples including missed or incorrect doses due to several factors, such as injection pain, preparation complexity, and the non-collection of prescriptions.

So, as another hypothetical, what type of value-based pricing strategy could be deployed by a pharmaceutical company with a therapy facing biosimilar competition if it introduced a new proprietary version that improved patient compliance or persistence rates by 20% or more over a 12- to 24-month period? Furthermore, how could such enhancements to the combination product, particularly those of a proprietary nature in which it may be difficult to generate equivalence according to regulatory processes, help to extend the commercial lifecycle?

CAPTURING VALUE

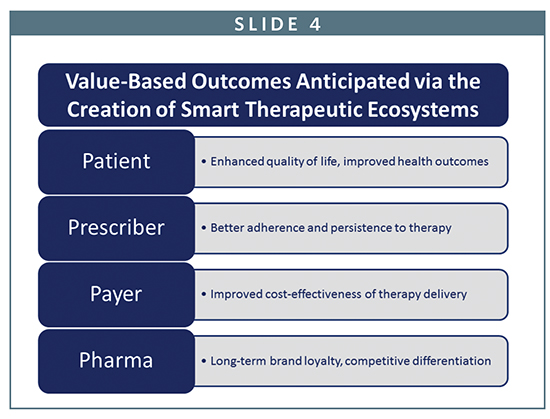

As prescribers, payers, and government agencies all begin to prioritize the use and reimbursement of therapies that deliver the best socioeconomic healthcare outcomes, pharmaceutical companies recognize they must be able to precisely quantify why their therapeutic brand represents the most attractive, long-term competitive value.

Within this new age of healthcare, a simple rule is fast gaining traction – the drug with the best data wins. Given how influential value-based information will be in the decision-making processes of patients, payers, and prescribers, it is not hard to see why data informatics is poised to become a primary healthcare battleground throughout the next decade.

But how does a pharmaceutical company make the collection of data accurate, reliable, and above-all, patient-proof? Especially when much of the data must come directly from patients who will be self-administering high-value biologics on an infrequent basis while they are otherwise pursuing normal daily routines around the home, work, or other social environments, such as the gym or café?

Furthermore, how should such information, once captured and encrypted, be securely transmitted from the patient to data hubs and stored for real-time or historic access by authorized personnel without breaching HIPAA regulations and other privacy laws? And finally, how should all of this data be structured and stored, and by who, for efficient analysis and comparison to generate quality insights on either a single-patient basis, or for an entire patient population?

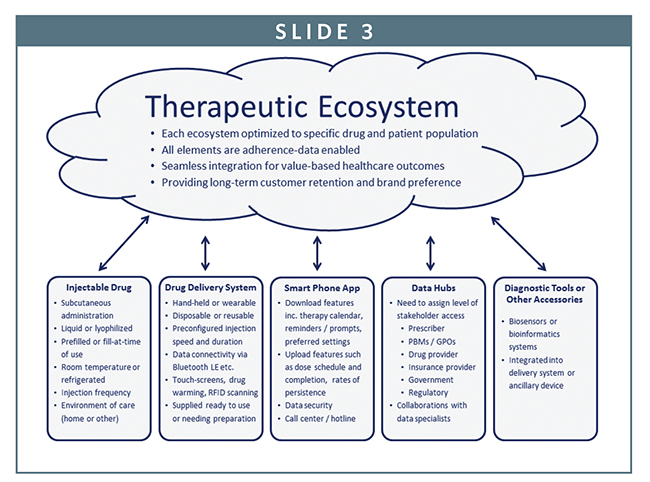

To address such issues, many pharmaceutical companies are seeking to create therapeutic ecosystems that not only capture and process data, but also build and maintain long-term trust amongst consumers and purchasers. Within each ecosystem, a therapy will be provided with a range of value-adding technologies and related services, including mobile apps, devices, cloud computing, biosensors, and diagnostic tools. Many, if not all, of these technologies will be adherence data-enabled.

To ensure each component of an ecosystem works seamlessly with all the other parts, long-term collaborations between drug, device, and data specialists will commence early during the clinical development of a therapy and then extend across its regulatory approval and commercial lifecycle will prove critical.

From the perspective of a pharmaceutical company, the synchronization of these smart technologies under one fully integrated ecosystem can fundamentally transform the nature of how they interact with patients, prescribers, and payers. Instead of just selling a drug, a pharmaceutical company can become a healthcare solutions service-provider that is fully engaged across the continuum of care.

As has been demonstrated in other markets being redefined by data, such as music by Apple, or books and retail by Amazon, such one-stop ecosystems are highly coveted by consumers and can inspire strong brand loyalty.

The use of smart-phone apps, such as health and wellness teaching aids and patient medication adherence programs, or ancillary wearable devices, such as smart watches and fitness bands with Bluetooth LE connectivity, have already started to be utilized in the creation of these therapeutic ecosystems.

In one example of what’s already possible, a diabetes industry leader has created a system that links a durable insulin pump to an app on a person’s iPhone®, enabling them to easily view pump and glucose information, including active insulin levels, calibration time, insulin in reservoir, connection status, and battery level. An authorized physician can also view the patient’s information online to monitor adherence and adjust a regimen if necessary.

However as with any early generation new technology, there are limitations. An additional uploader device must be separately purchased by the user at extra cost to enable communication between the smartphone and the pump. Perhaps due to potential regulatory or technical challenges, the system also does not enable the user to control the rate or timing of insulin delivery via their smartphone, which could potentially provide benefits in some social environments.

With every secondary piece of equipment that is required, extra cost that must be incurred, or additional website or app that must be visited, complexity is added to the user experience, and the overall value proposition for a therapy is diminished. A seamless therapeutic ecosystem experience will therefore only truly exist once future generations of smart technologies become available that not only monitor therapeutic outcomes, but deliver them as well.

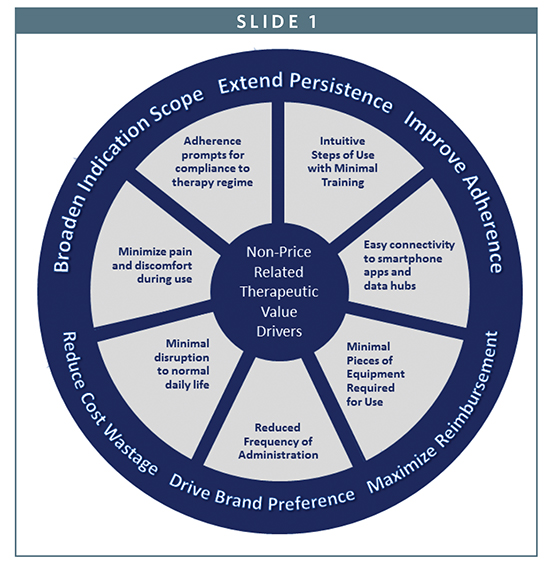

This next wave of change will bring drug, device, and data hub together into one fully integrated package to provide a seamless user experience. Such ready-to-use products, where the device will serve as an primary interface between the drug, patient, and data hub, will be capable of doing it all…contain, deliver, monitor, and communicate.

SMART TECHNOLOGIES

Over the coming decade, these therapeutic ecosystems will be enabled or enhanced by a new wave of smart technologies with a range of embedded features and user-centric functionality. Each will have been developed and refined during the clinical development and regulatory approval process for a therapy to ensure it not only addresses the specific needs and expectations of a well-defined patient population, but also provides attractive benefits for prescribers and payers.

To help shift the place of treatment from the clinic to the home, or anywhere else the patient happens to be during a normal day, they will be commonly supplied in a prefilled or ready-to-use format that saves time, reduces bulk, and encourages portability. To fully empower patients to maintain long-term compliance with their prescribed therapy regimen, they will be intuitive to use and discreet in appearance. Some may not look like a traditional therapeutic product at all, but instead more closely resemble an electronic device or cosmetic product. And to enable the automatic uploading or downloading of data, they will feature Bluetooth LE or some related technology for seamless connection to therapy-specific apps that have been downloaded onto the patient’s smartphone or tablet.

Outside of insulin, where durable insulin pumps are expected to continue growing in popularity, or novel concepts, such as smart contact lenses, there are two new categories of adherence-enabled devices that are expected to play a key role in the acceleration of this market shift to smart therapeutic technologies.

HAND-HELD SMART REUSABLE AUTOINJECTORS

For therapies designed for the patient, self-administration of a small dose volume on a frequent to semifrequent basis, such as every day, week, or fortnight, smart reusable autoinjectors that minimize the average cost per injection will be utilized with prefilled syringes.

An early taste of things to come is the BetaConnect® autoinjector that has recently begun to be marketed across various international regions by Bayer with its Betaferon® therapy for the treatment of multiple sclerosis. The system has been configured for use with the myBETAapp to upload data to a smartphone or computer using a Bluetooth or USB connection. The app can set reminder alerts for the next injection, with a calendar of all injections that have been scheduled, recorded, or missed. This injection history can be emailed directly to the patient, as well as the healthcare provider.

Such emerging technologies, particularly when synched with intuitive smartphone apps, can remind patients when to collect or take their dose, monitor health throughout the continuum of care, and alert healthcare stakeholders to potential issues before they become serious. In addition to leveraging the benefits of data informatics, these smart devices, which are designed for use up to hundreds of times before disposal or replacement, can further drive value by significantly reducing the average cost per dose over a multi-year period when compared to standard disposable autoinjectors.

Future generations of smart reusable autoinjectors may also be equipped with other features that can provide value-based healthcare outcomes in areas, such as therapy adherence, drug security, and data management. For example, through the inclusion of an automatic heating system, smart reusable autoinjectors will quickly warm a refrigerated biologic to room temperature to reduce patient pain or sensitivity during the injection process, and improve pre-injection waiting times from between 20 to 30 minutes to less than a minute.

Alternatively, autoinjector features that allow users to pre-select and store preferred settings for the speed or depth of an injection can help to reduce pain and improve rates of user preference. This may be especially important with therapies in which it is common to rotate the site of subcutaneous injection. The integration of RFID/NCC tag readers within the autoinjector will also allow devices to scan each dose of prefilled therapy to confirm it has not expired, that it is the prescribed strength, and that it is has not been tampered with prior to use.

When specifically designed for use with proprietary prefilled syringes, such as those provided by Unilife with automatic needlestick retraction, smart reusable autoinjectors also create opportunities for a pharmaceutical company to follow a marketing strategy similar in many ways to the well-known Gillette razorblade model. Under such a strategy, the smart reusable autoinjector could be provided to patients either for free or at a subsidized price. As the autoinjector would be configured only for use with a specific brand of therapy, through the use of a bar code reader or the custom design of the prefilled syringe, the device would restrict use with other competing generic or biosimilar brands. Such practices create opportunities for a pharmaceutical company to build strong rates of user preference for the prefilled brand of therapy, and encourage long-term customer retention.

WEARABLE SMART DISPOSABLE INJECTORS

While patient-monitoring devices, such as biometric sensors that can be worn on the body, are already helping to redefine the boundaries of patient self-care, even greater healthcare outcomes are anticipated once wearable smart disposable injectors become common in the subcutaneous administration of injectable therapies across therapy areas such as oncology and autoimmune diseases.

Outside of disposable or durable insulin pumps, many wearable injectors will be supplied ready to self-administer biologics between 1 mL and 15 mL in dose volume over pre-set periods between 20 seconds and several hours on an infrequent basis, such as every 2 weeks, month, or quarter. These devices will enable convenient, comfortable, and discreet patient wear during the period of dose delivery, as well as compact disposal.

In addition to many of the same features that will be available with smart reusable autoinjectors, smart wearable injectors also create a number of other opportunities to unlock healthcare value due to the nature by which they can be worn on the body for extended periods of time.

For example, early generations of smart wearable injectors will have the capacity to be stuck onto the body, and then leverage the patient’s own body heat to quickly warm a drug to room temperature prior to the automatic initiation of dose delivery to minimize patient pain and sensitivity. When integrated with smartphone apps, they will also be able to discreetly inform the user regarding injection status and the expected time until the completion of dose delivery.

In the longer-term, closed-loop systems, such as next-generation insulin pumps with integrated continuous glucose-monitoring technologies, create opportunities for a device to adjust the administration of a therapy regimen to the patient’s specific health requirements in real-time. These therapy-specific outcomes may be feasible either via biosensors and bioinformatics programs embedded into the device or smartphone app, or by allowing some level of control by the user. Such advances, which would extend the device’s role well beyond the simple monitoring or pre-set delivery of a drug at a designated rate or duration, is however likely to be the subject of rigorous scrutiny by regulatory agencies.

OPPORTUNITIES FOR BIOPHARMA

The convergence of big pharma, big data, and smart devices will be instrumental in improving rates of therapy adherence, enhancing patient quality of life and creating financial efficiencies across the healthcare spectrum. In particular, the creation of cohesive therapeutic ecosystems will enable patients, prescribers, and payers to make informed decisions about the comparative value and effectiveness of competing brands of therapy.

Pharmaceutical companies that can remain at the leading edge of this wave will be strongly positioned to justify the competitive value of their therapy brands, build long-term patient relationships, and maximize revenue. In addition, the value of this data is expected to further reduce costs by shortening clinical development timelines for pipeline drugs, and providing enhanced patient information that can maximize the likelihood of regulatory approval and expanded indications for use.

To view this issue and all back issues online, please visit www.drug-dev.com.

Stephen Allan is a communications, marketing, and strategic planning specialist for injectable drug delivery systems with more than a dozen years of international industry expertise. As Senior-Vice President of Strategic Planning at Unilife, he is responsible for the assessment of unmet industry needs and emerging market trends relating to the containment and delivery of injectable therapies, and the development of differentiated brand marketing strategies for advanced drug delivery technologies. Stephen is also the Director of Pennsylvania Bio. He can be reached at stephen.allan@unilife.com or (717) 805-8607.

Total Page Views: 3671